By Press Release

Avison Young completes off-market building acquisition on behalf of Chaffey Federal Credit Union in Upland, CA

May 20th, 2020 — Avison Young has announced that it has completed the $1.285 million off-market sale of a 4,080-square-foot (sf) multi-tenant building located at 1014 West Foothill in Upland, CA, on behalf of its client, Chaffey Federal Credit Union. The acquisition was a strategic move for the credit union as it expands its reach throughout the region. It has been a tenant within the property and will continue to use the space for administrative purposes with the flexibility to expand into additional space in the future.

Avison Young Principal Hayden Eaves along with Kristen Sullivan and Matthew Spear, who are all based out of the firm’s downtown Los Angeles office, represented Chaffey. The same team also represented the seller, Steven’s Hope for Children, a nonprofit organization that will continue to be a tenant at the property and negotiated a lease with the new ownership.

“This acquisition was ideal for Chaffey as its 6,100-sf headquarters and main branch location is directly across the street at 1024 West Foothill,” said Eaves. “Chaffey was running out of room at its existing headquarters and this property provides them with the opportunity to seamlessly expand without having to look for new location.”

Founded in 1964, Chaffey Federal Credit Union is a not-for-profit, member-owned financial cooperative providing banking services to multiple business groups. It primarily serves education employees in the Inland Empire and San Gabriel Valley communities. In addition to Upland, Chaffey also has locations in Rancho Cucamonga and West Covina.

“Chaffey Federal Credit Union has experienced solid growth in recent years and needed to explore and develop a facilities and branch strategy,” said Chaffey Federal Credit Union’s Chief Executive Officer Kevin Posey. “Hayden and his team have been terrific partners as they have helped advise us on a plan that best suits our current and future expansion needs. We are excited to work with Hayden and the Avison Young team as we complete these projects and embark on the next phase of our strategy.”

Posey added that in February 2020, the Avison Young team also negotiated a new lease on Chaffey’s behalf for a newly constructed, high profile retail location totaling 2,030 sf at 847 W Foothill Blvd. in Upland.

Chaffey Federal Credit Union (CFCU) has provided personal financial solutions and quality service since 1964. As a not-for-profit, federally chartered, full service financial institution owned entirely by its members, the main objective is to help its member/owners achieve and maintain financial well-being. It provides a wide variety of free and low-cost financial services, plus low loan rates and competitive savings rates.

When you open a regular share savings account, you become a shareholder, meaning that you are one of the Credit Union’s owners as well as one of its members. You have the right to vote for the Board of Directors each year and to run or volunteer for office yourself, if you choose.

Because the Credit Union returns its earnings to its members as dividends (after expenses and reserves), the Credit Union is able to offer higher savings rates and extremely competitive loan rates as well as numerous free and low-cost financial services. Chaffey Federal Credit Union is one of the safest financial institutions in America. Your aggregate savings deposits are insured up to $250,000 by the National Credit Union Administration (NCUA), an agency of the federal government. American Share Insurance provides an additional $250,000 in coverage — for combined coverage of up to $500,000.

IRAs are separately insured up to $500,000 with combined federal and private insurance. An additional $250,000 on aggregate savings accounts and IRAs is insured by American Share Insurance Corporation (ASI).

Avison Young is the world’s fastest-growing commercial real estate services firm. Headquartered in Toronto, Canada, Avison Young is a collaborative, global firm owned and operated by its Principals. Founded in 1978, with legacies dating back more than 200 years, the company comprises thousands of real estate professionals in more than 100 offices around the world. The firm’s experts provide value-added, client-centric investment sales, leasing, advisory, management and financing services to clients across the office, retail, industrial, multi-family and hospitality sectors.

Avison Young is a 2020 winner of the Canada’s Best Managed Companies Platinum Club designation, having retained its Best Managed designation for nine consecutive years.

Follow Avison Young

Twitter (News) │ Twitter (Deals) │ Blog │ LinkedIn │ YouTube │ Instagram

By Press Release

Stockbridge Acquires 540,478 SF Inland Empire Industrial Portfolio for $142MM

San Francisco based Stockbridge acquires 100% leased assets in premier IE West location

Cushman & Wakefield’s EDSF also sources acquisition financing for transaction

Cushman & Wakefield announced the firm has arranged the sale of a core industrial portfolio totaling 540,478 square feet in Southern California’s premier Inland Empire West (IEW) submarket. The portfolio consists of two freestanding Class A buildings located a few miles apart at 3351 E Philadelphia St and 4450 E Lowell St in the city of Ontario. The buildings are 100% leased to prominent tenants in the distribution and retail industries.

San Francisco based Stockbridge acquired the two-property portfolio from Principal Asset ManagementSM a global financial and investment management firm. The portfolio sold for $142.25 million.

Jeff Chiate, Jeffrey Cole, Rick Ellison, and Matt Leupold of Cushman & Wakefield’s National Industrial Advisory Group—West represented the seller in the transaction. The firm’s Phil Lombardo, Chuck Belden and Andrew Starnes also provided leasing advisory.

Additionally, a Cushman & Wakefield Equity, Debt & Structured Finance (EDSF) team of Rob Rubano, Brian Share, Joseph Lieske, Max Schafer, and Becca Tse collaborated in sourcing acquisition financing for the transaction.

“Stockbridge has acquired an institutional-quality industrial portfolio with a phenomenal infill location combined with strong tenancy and premium distribution features and functionality. Both properties have maintained a historical occupancy of 100% for nearly a decade speaking to the tenant demand for industrial buildings of this quality and location,” said Jeff Chiate, Executive Vice Chair. “Additionally, with current rents below market rate, the buyer has a compelling mark-to market opportunity along with existing durable cash flow, providing a variety of value-add strategies.”

The properties offer convenient access to Southern California’s robust freeway network and other vital nodes of transit such as Ontario International Airport, the Los Angeles & Long Beach Ports, and LAX International Airport (60 miles). Access to a deep labor pool and robust consumer population also makes the region a superior industrial location.

According to Cushman & Wakefield’s latest industrial market report, the Inland Empire West submarket had a vacancy rate of 5.4% in Q1 2024, representing the tightest submarket in the broader Inland Empire market. Additionally, IEW achieved nearly 1 million square feet of positive net absorption (occupancy growth) in the first quarter of 2024.

By Press Release

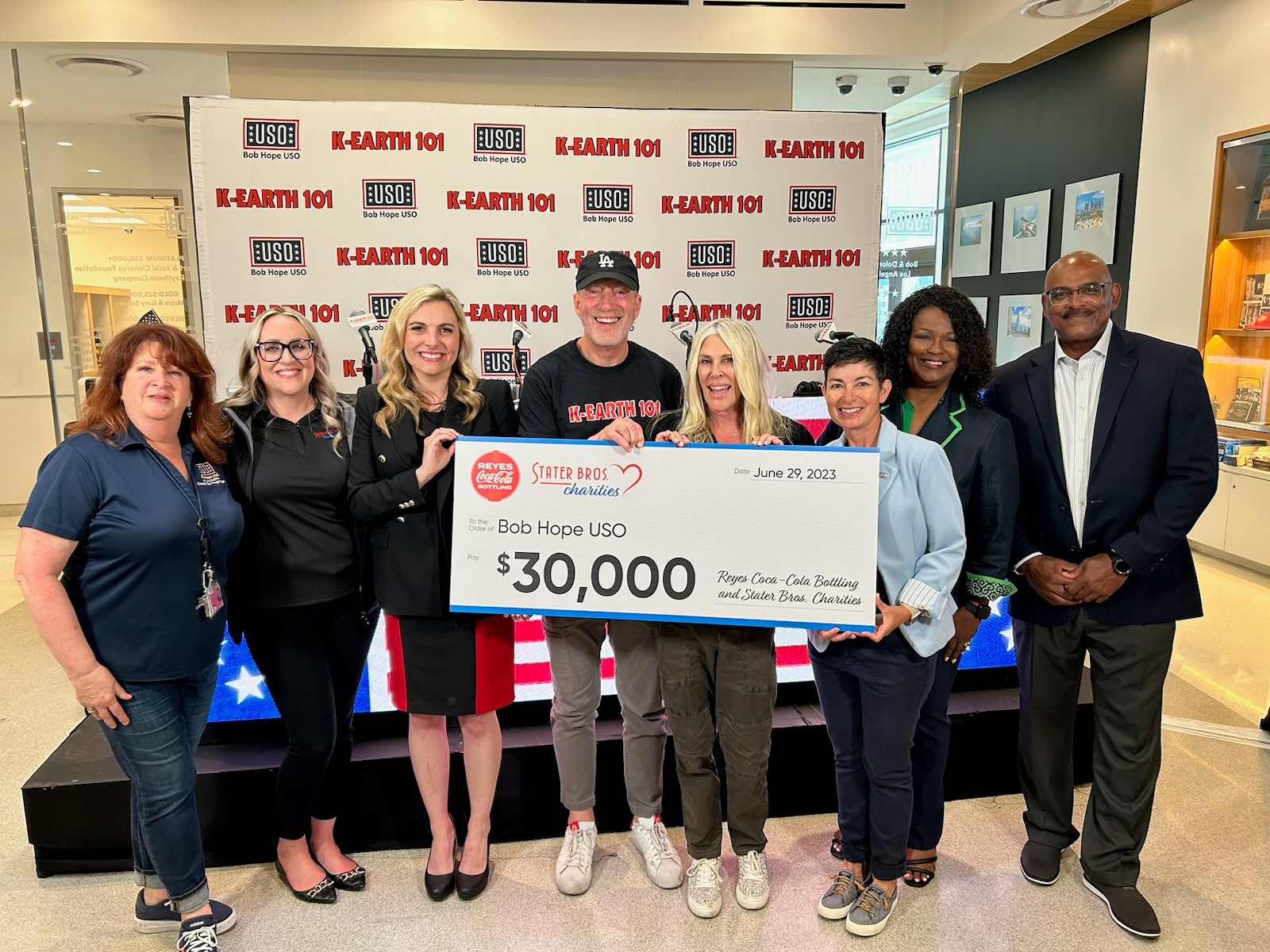

Stater Bros. Charities and Reyes Coca-Cola Bottling Give Back to Military Families

Stater Bros. Charities, the philanthropic arm of Stater Bros. Markets, partnered with Reyes Coca-Cola Bottling again this year for their Give Back program during National Military Appreciation Month. The program ran for the entire month of May, during which Reyes Coca-Cola Bottling committed to donating $0.25 per eligible product purchased to the Bob Hope USO. Reyes Coca-Cola Bottling donated $15,000, and Stater Bros. Charities matched their donation for a total contribution of $30,000.

A check presentation occurred during a K-EARTH 101 radiothon benefiting the Bob Hope USO. The radiothon took place at the Bob Hope USO at LAX (Los Angeles International Airport) on June 29, 2023, where Stater Bros. Charities and Reyes Coca-Cola Bottling presented Bob Hope USO with a $30,000 check.

Bob Hope USO’s mission is to strengthen America’s military service members by keeping them connected to family, home and country, throughout their service to the nation. The Give Back program is a unique opportunity to show gratitude and support to the brave men and women who risk their lives for our freedoms and to care for their families while they are away from home on deployment.

“Stater Bros. Markets has a long history of supporting veterans, service members, and their families,” said Danielle Oehlman, Director, Stater Bros. Charities. “We are so pleased to partner with our friends at Reyes Coca-Cola Bottling and the USO to give back to those who have given so much for us.”

Lorin Stewart, President, USO West Region, said, “We are deeply grateful to Stater Bros. Charities and Reyes Coca-Cola Bottling for being sustaining partners of the USO. The Give Back program embodies the essence of the USO mission by enabling the community at large to come together to support and give thanks to our armed forces and their brave military families in an impactful way.”

Funds will support the Bob Hope USO and USO San Diego Center operations, including programs and services that strengthen the social, mental, physical, and emotional well-being of local military service members, their families, and their communities.

By Press Release

BDK Logistics Intelligence Fully Leases 114,190 SF Industrial Facility in Corona, CA

Cushman & Wakefield represents landlord in lease in SoCal’s Inland Empire

Cushman & Wakefield announced that BDK Logistics Intelligence, Inc. has signed a lease for an entire 114,190-square-foot industrial facility at 1161 Olympic Drive in Corona, California. Situated in Southern California’s renowned Inland Empire, the building is owned by Monterey Rancho Mirage, LLC, which was represented by Brett Lockwood and Rick Ellison of Cushman & Wakefield in the transaction.

“We are pleased to welcome BDK to the property as a quality industrial tenant that is expanding its presence in the market, which it also currently occupies multiple warehouse facilities,” said Director Brett Lockwood. “Our client was instrumental in helping this deal transact as there were many variables that needed to be navigated which led to this lease coming together quickly and successfully.”

1161 Olympic Drive is a quality freestanding building situated on ±4.8 acres and features 20 dock high loading doors. The property is conveniently located off Interstate 15 near the confluence of SR 91 and is proximate to the extensive freeway network traversing the entire Greater Los Angeles region and into other major markets in and out of state.

According to Cushman & Wakefield’s latest Q2-2023 quarterly report, the Inland Empire industrial market posted an overall vacancy of 3.4% and has recorded more than 2.7 million square feet of positive net absorption through the first half of 2023.

-

Technology4 months ago

Technology4 months agoLA Tech Week Highlights Southern California’s Expanding Tech Ecosystem

-

Bizz Buzz3 months ago

Bizz Buzz3 months agoRegency Centers Unveils Oak Valley Village: A New Retail Hub Coming to Beaumont, CA

-

Entertainment3 months ago

Entertainment3 months agoROI: Return on Insanity—Lucha VaVoom’s High-Yield Investment in the Pomona Arts Colony

-

Food & Lifestyle4 months ago

Food & Lifestyle4 months agoFogo de Chão Heats Up Rancho Cucamonga Dining Scene

-

Travel & Tourism3 months ago

Travel & Tourism3 months agoFly Ontario, Calif., to Honolulu aboard Southwest Airlines starting in June

-

Transportation2 months ago

Transportation2 months agoRegional Leaders Launch “Coalition for Our Future” to Advance Urgent Safety Solutions for I-15 Corridor