By Press Release

9494 Haven Renovation Brings Modern Campus to the Inland Empire

Newmark Knight Frank Leads Leasing Effort for Renovated Office

Rancho Cucamonga, CA (January 8, 2020) – 9494 Haven, located in the city of Rancho Cucamonga, has undergone extensive renovation providing a modern more than 61,000-square-foot, two-story office campus to the market. The renovation increases the building area of the property, which was built in 2004, by approximately 32,000 square feet with the addition of second floor office space, further raising the bar for the quality of conventional office space in the market.

According to Newmark Knight Frank (NKF) Senior Managing Director Drew Sanden, who along with Senior Managing Director Taylor Ing and Senior Associate Scott Maples, represent 9494 Haven, the property represents the largest contiguous block of space now available in the Rancho Cucamonga/Ontario submarket.

9494 Haven fronts Haven Avenue, recognized as the main North/South artery in Ontario/Rancho Cucamonga, offers a strong identity and signage opportunity for prospective tenants. The property also provides a +6:1000 parking ratio. Along with the addition of the second-floor, the owner is modernizing 9494 Haven’s building exterior, creating a separate identity and curb appeal for the new office space. The exterior renovations include window cutouts to encourage greater natural light throughout, wood paneling, a glass curtain wall lobby and additional high-end finishes. All renovations are scheduled for completion in February 2020.

“9494 Haven will be one of the only truly modern campuses in the area. This property comes to market at an opportune time as market fundamentals continue to improve and demand for well-branded campus-style locations is strong,” said Sanden.

According to NKF 4Q 2019 Inland Empire Office Market Report, vacancy is now at 8.8 percent in the region and has remained below 10 percent for nine straight quarters. Although speculative construction is occurring, it is nominal and new construction is minimal; most tenants are renewing, and rent growth is becoming more pronounced. Overall, the story for the Inland Empire remains one of affordable housing relative to Southern California’s coastal communities, which favors ongoing population growth, supporting office space demand from government, legal service firms and trade schools.

“The lack of large blocks of available office space in the Inland Empire is another aspect that supports the value of this renovation. The west region only has four vacancies over 30,000 square feet, including 9494 Haven. All the available spaces are second generation except for 9494 Haven which is in shell condition.” Sanden added.

About Newmark Knight Frank

Newmark Knight Frank (“NKF”), operated by Newmark Group, Inc. (“Newmark Group”) (NASDAQ: NMRK), is one of the world’s leading and most trusted commercial real estate advisory firms, offering a complete suite of services and products for both owners and occupiers. Together with London-based partner Knight Frank and independently-owned offices, NKF’s 18,000 professionals operate from approximately 480 offices on six continents. NKF’s investor/owner services and products include investment sales, agency leasing, property management, valuation and advisory, diligence, underwriting, government-sponsored enterprise lending, loan servicing, debt and structured finance and loan sales. Occupier services and products include tenant representation, real estate management technology systems, workplace and occupancy strategy, global corporate services consulting, project management, lease administration and facilities management. For further information, visit www.ngkf.com.

Discussion of Forward-Looking Statements about Newmark

Statements in this document regarding Newmark that are not historical facts are “forward-looking statements” that involve risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements. Except as required by law, Newmark undertakes no obligation to update any forward-looking statements. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see Newmark’s Securities and Exchange Commission filings, including, but not limited to, the risk factors and Special Note on Forward-Looking Information set forth in these filings and any updates to such risk factors and Special Note on Forward-Looking Information contained in subsequent reports on Form 10-K, Form 10-Q or Form 8-K.

By Press Release

Stockbridge Acquires 540,478 SF Inland Empire Industrial Portfolio for $142MM

San Francisco based Stockbridge acquires 100% leased assets in premier IE West location

Cushman & Wakefield’s EDSF also sources acquisition financing for transaction

Cushman & Wakefield announced the firm has arranged the sale of a core industrial portfolio totaling 540,478 square feet in Southern California’s premier Inland Empire West (IEW) submarket. The portfolio consists of two freestanding Class A buildings located a few miles apart at 3351 E Philadelphia St and 4450 E Lowell St in the city of Ontario. The buildings are 100% leased to prominent tenants in the distribution and retail industries.

San Francisco based Stockbridge acquired the two-property portfolio from Principal Asset ManagementSM a global financial and investment management firm. The portfolio sold for $142.25 million.

Jeff Chiate, Jeffrey Cole, Rick Ellison, and Matt Leupold of Cushman & Wakefield’s National Industrial Advisory Group—West represented the seller in the transaction. The firm’s Phil Lombardo, Chuck Belden and Andrew Starnes also provided leasing advisory.

Additionally, a Cushman & Wakefield Equity, Debt & Structured Finance (EDSF) team of Rob Rubano, Brian Share, Joseph Lieske, Max Schafer, and Becca Tse collaborated in sourcing acquisition financing for the transaction.

“Stockbridge has acquired an institutional-quality industrial portfolio with a phenomenal infill location combined with strong tenancy and premium distribution features and functionality. Both properties have maintained a historical occupancy of 100% for nearly a decade speaking to the tenant demand for industrial buildings of this quality and location,” said Jeff Chiate, Executive Vice Chair. “Additionally, with current rents below market rate, the buyer has a compelling mark-to market opportunity along with existing durable cash flow, providing a variety of value-add strategies.”

The properties offer convenient access to Southern California’s robust freeway network and other vital nodes of transit such as Ontario International Airport, the Los Angeles & Long Beach Ports, and LAX International Airport (60 miles). Access to a deep labor pool and robust consumer population also makes the region a superior industrial location.

According to Cushman & Wakefield’s latest industrial market report, the Inland Empire West submarket had a vacancy rate of 5.4% in Q1 2024, representing the tightest submarket in the broader Inland Empire market. Additionally, IEW achieved nearly 1 million square feet of positive net absorption (occupancy growth) in the first quarter of 2024.

By Press Release

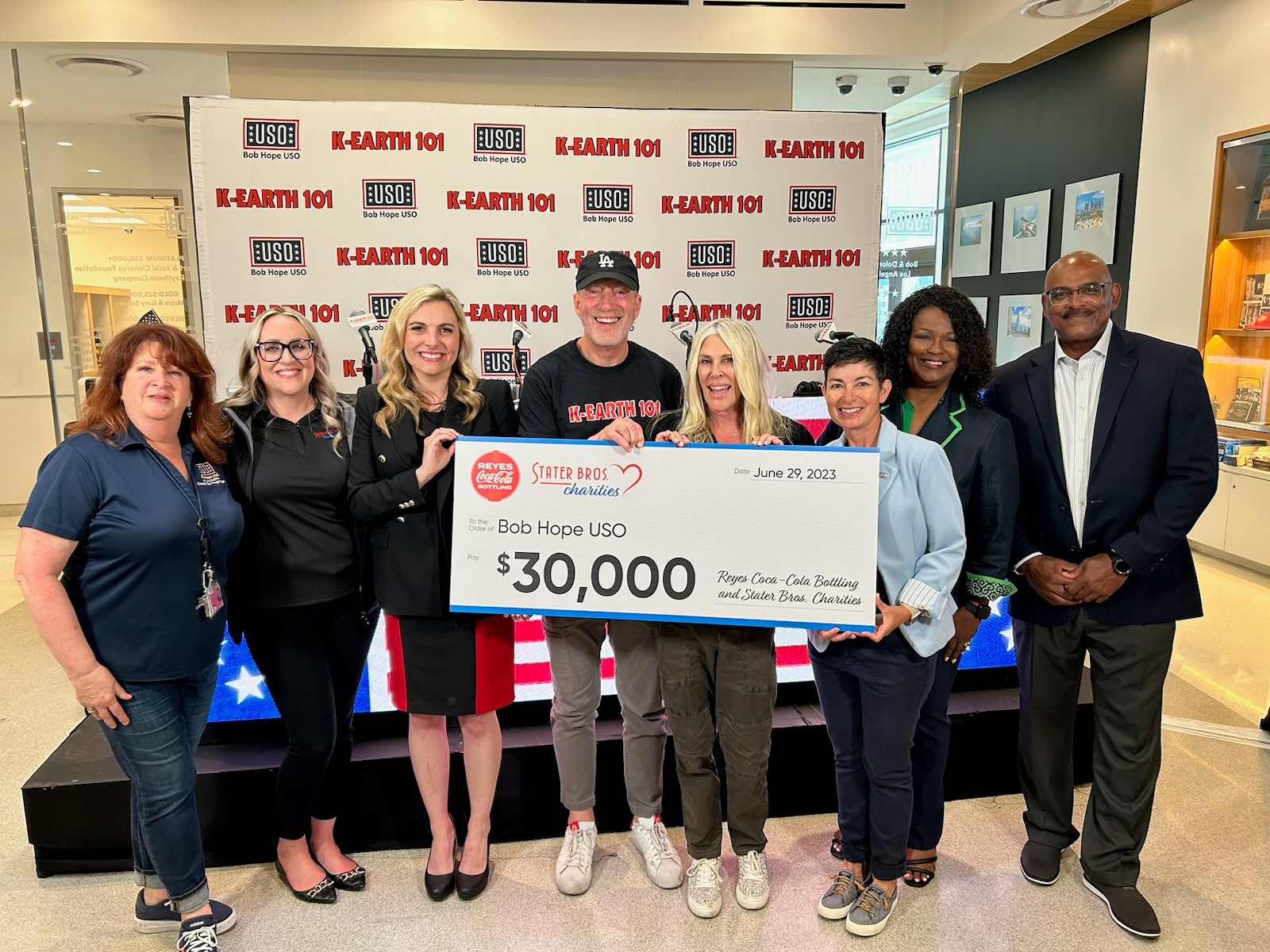

Stater Bros. Charities and Reyes Coca-Cola Bottling Give Back to Military Families

Stater Bros. Charities, the philanthropic arm of Stater Bros. Markets, partnered with Reyes Coca-Cola Bottling again this year for their Give Back program during National Military Appreciation Month. The program ran for the entire month of May, during which Reyes Coca-Cola Bottling committed to donating $0.25 per eligible product purchased to the Bob Hope USO. Reyes Coca-Cola Bottling donated $15,000, and Stater Bros. Charities matched their donation for a total contribution of $30,000.

A check presentation occurred during a K-EARTH 101 radiothon benefiting the Bob Hope USO. The radiothon took place at the Bob Hope USO at LAX (Los Angeles International Airport) on June 29, 2023, where Stater Bros. Charities and Reyes Coca-Cola Bottling presented Bob Hope USO with a $30,000 check.

Bob Hope USO’s mission is to strengthen America’s military service members by keeping them connected to family, home and country, throughout their service to the nation. The Give Back program is a unique opportunity to show gratitude and support to the brave men and women who risk their lives for our freedoms and to care for their families while they are away from home on deployment.

“Stater Bros. Markets has a long history of supporting veterans, service members, and their families,” said Danielle Oehlman, Director, Stater Bros. Charities. “We are so pleased to partner with our friends at Reyes Coca-Cola Bottling and the USO to give back to those who have given so much for us.”

Lorin Stewart, President, USO West Region, said, “We are deeply grateful to Stater Bros. Charities and Reyes Coca-Cola Bottling for being sustaining partners of the USO. The Give Back program embodies the essence of the USO mission by enabling the community at large to come together to support and give thanks to our armed forces and their brave military families in an impactful way.”

Funds will support the Bob Hope USO and USO San Diego Center operations, including programs and services that strengthen the social, mental, physical, and emotional well-being of local military service members, their families, and their communities.

By Press Release

BDK Logistics Intelligence Fully Leases 114,190 SF Industrial Facility in Corona, CA

Cushman & Wakefield represents landlord in lease in SoCal’s Inland Empire

Cushman & Wakefield announced that BDK Logistics Intelligence, Inc. has signed a lease for an entire 114,190-square-foot industrial facility at 1161 Olympic Drive in Corona, California. Situated in Southern California’s renowned Inland Empire, the building is owned by Monterey Rancho Mirage, LLC, which was represented by Brett Lockwood and Rick Ellison of Cushman & Wakefield in the transaction.

“We are pleased to welcome BDK to the property as a quality industrial tenant that is expanding its presence in the market, which it also currently occupies multiple warehouse facilities,” said Director Brett Lockwood. “Our client was instrumental in helping this deal transact as there were many variables that needed to be navigated which led to this lease coming together quickly and successfully.”

1161 Olympic Drive is a quality freestanding building situated on ±4.8 acres and features 20 dock high loading doors. The property is conveniently located off Interstate 15 near the confluence of SR 91 and is proximate to the extensive freeway network traversing the entire Greater Los Angeles region and into other major markets in and out of state.

According to Cushman & Wakefield’s latest Q2-2023 quarterly report, the Inland Empire industrial market posted an overall vacancy of 3.4% and has recorded more than 2.7 million square feet of positive net absorption through the first half of 2023.

-

Technology3 months ago

Technology3 months agoLA Tech Week Highlights Southern California’s Expanding Tech Ecosystem

-

Entertainment2 months ago

Entertainment2 months agoROI: Return on Insanity—Lucha VaVoom’s High-Yield Investment in the Pomona Arts Colony

-

Bizz Buzz2 months ago

Bizz Buzz2 months agoRegency Centers Unveils Oak Valley Village: A New Retail Hub Coming to Beaumont, CA

-

Food & Lifestyle3 months ago

Food & Lifestyle3 months agoFogo de Chão Heats Up Rancho Cucamonga Dining Scene

-

Travel & Tourism2 months ago

Travel & Tourism2 months agoFly Ontario, Calif., to Honolulu aboard Southwest Airlines starting in June

-

Transportation1 month ago

Transportation1 month agoRegional Leaders Launch “Coalition for Our Future” to Advance Urgent Safety Solutions for I-15 Corridor