By Press Release

How Long Can The U.S. Economic Expansion Last? Leading Forecast Sees Growth Through 2021

Health Care, Hospitality Industries Driving California Job Growth; Home Price Appreciation in State Showing Signs of Exhaustion

News Release — December 11, 2019 — Los Angeles, CA — Looking back at the turmoil and off-putting theatrics that have characterized U.S. politics for much of 2019, one item that will not make the year’s ‘list of negatives’ is the health of the nation’s economy—and that isn’t changing any time soon, according to a new forecast released by Beacon Economics. Today, the U.S. economy is in the midst of the longest expansion in recorded history and, despite dour headlines to the contrary, is expected to continue along that same growth trajectory for at least the next two years.

“This outlook puts us squarely on the bullish side of things and outside mainstream opinion, but the facts as we see them simply don’t support a more negative narrative,” said Christopher Thornberg, Founding Partner of Beacon Economics and one of the forecast authors. “Currently, there is little sign of the kind of collapsing imbalances or rapid shifts in aggregate demand that would be capable of pushing the economy into a downturn or even a protracted slow growth slump.” According to the new forecast, U.S. GDP will see 2% plus real growth in 2020 and will move towards 2.5% real growth in 2021. To date, the first three quarters of 2019 have averaged 2.3% growth.

This should not imply that there aren’t stressors on the economy warns the outlook, but rather that nothing on the current horizon rises to the level of imbalance or shock that could cause a downturn. However, Thornberg cautions that the outlook could change and that it is critical to maintaining vigilance in monitoring economic trends and activity given the unpredictability and hyper-partisan nature of current U.S. policymaking.

Moreover, while the nation unnecessarily flirts with short-run disasters, looming, long-run threats clearly imperil the nation’s economic health. “The healthcare cost crisis, the desperate need for pension and entitlement reform, dangerous trends in wealth inequality, among other issues are serious and growing risks that are largely being ignored and will come back to haunt us—the only question is when,” said Thornberg.

Like the nation as a whole, California’s economy also continues along a steady growth path, even hitting a number of significant milestones in the last quarter. To date, the state’s unemployment rate has dipped to a historically low 3.9% as both worker wages and employment have reached all-time highs. “The longer the current expansion persists, the closer we are to the next recession,” said Taner Osman, Research Manager at Beacon Economics and one of the forecast authors. “But business cycles do not die of old age and, at present, there are few signs of a slowdown in the state’s economy.”

Key Findings:

- Much of the confidence surrounding the health of the U.S. economy lies with the consumer. A brief lull in spending growth at the end of 2018 reversed itself by the end of the first quarter of 2019. Consumer spending is now growing at roughly the same pace as U.S. GDP.

- Falling interest rates are the reason the nation’s housing market is starting to bounce back with sales of new and existing homes up and home price appreciation beginning to accelerate. Moreover, none of the conditions for a major housing bust are in play… we’ve seen clean mortgage lending, no excess supply being built, and increases in overall affordability as measured by the housing cost share of income for U.S. households.

- As a result of record-tight labor markets, many U.S. workers have seen significant jumps in earnings. In 2014, compensation for employees made up 60% of national income compared to 63% in 2019. Notably, most of this income has shifted from corporate profits, which fell from a near-record high of over 14% of all national income in 2014 to less than 12% this year.

- The one weak spot in the nation’s GDP data in 2019 was in business investment, however, spending is down in this area for a number of narrow reasons, but not many general ones. Weak export data has played some role in slowing investment, but overall, the impact of the trade war with China has been highly overrated.

- Employment in California keeps on soaring with the state economy adding 308,000 jobs (a 1.8% growth rate) from October 2018 to October 2019. Fully 40% of this job growth came from just two sectors, Healthcare and Social Assistance, and Leisure and Hospitality, indicative of a growing elderly population and strong consumer health. Notably, the rate of job growth in the nation as a whole, at 1.4%, was lower than in the state over this period.

- Home price growth in California finally started to show signs of exhaustion over the past year. The median price for a single-family home in California grew 2.2%, which when adjusted for inflation, means that price growth has effectively been flat. This should not be surprising given the relentless pace of appreciation that has occurred in recent years, something that cannot realistically continue.

- Building needed! Building permits in California peaked in the first quarter of 2018 but turned negative in the third quarter—and have remained there throughout 2019. Constrained housing supply will continue to hinder home affordability and limit growth in the state’s labor force.

Download the full forecast here for additional insights.

###

Beacon Economics is an independent economic research and consulting firm based in Los Angeles. This analysis was authored by Christopher Thornberg and Taner Osman. Learn more at www.beaconecon.com.

By Press Release

Stockbridge Acquires 540,478 SF Inland Empire Industrial Portfolio for $142MM

San Francisco based Stockbridge acquires 100% leased assets in premier IE West location

Cushman & Wakefield’s EDSF also sources acquisition financing for transaction

Cushman & Wakefield announced the firm has arranged the sale of a core industrial portfolio totaling 540,478 square feet in Southern California’s premier Inland Empire West (IEW) submarket. The portfolio consists of two freestanding Class A buildings located a few miles apart at 3351 E Philadelphia St and 4450 E Lowell St in the city of Ontario. The buildings are 100% leased to prominent tenants in the distribution and retail industries.

San Francisco based Stockbridge acquired the two-property portfolio from Principal Asset ManagementSM a global financial and investment management firm. The portfolio sold for $142.25 million.

Jeff Chiate, Jeffrey Cole, Rick Ellison, and Matt Leupold of Cushman & Wakefield’s National Industrial Advisory Group—West represented the seller in the transaction. The firm’s Phil Lombardo, Chuck Belden and Andrew Starnes also provided leasing advisory.

Additionally, a Cushman & Wakefield Equity, Debt & Structured Finance (EDSF) team of Rob Rubano, Brian Share, Joseph Lieske, Max Schafer, and Becca Tse collaborated in sourcing acquisition financing for the transaction.

“Stockbridge has acquired an institutional-quality industrial portfolio with a phenomenal infill location combined with strong tenancy and premium distribution features and functionality. Both properties have maintained a historical occupancy of 100% for nearly a decade speaking to the tenant demand for industrial buildings of this quality and location,” said Jeff Chiate, Executive Vice Chair. “Additionally, with current rents below market rate, the buyer has a compelling mark-to market opportunity along with existing durable cash flow, providing a variety of value-add strategies.”

The properties offer convenient access to Southern California’s robust freeway network and other vital nodes of transit such as Ontario International Airport, the Los Angeles & Long Beach Ports, and LAX International Airport (60 miles). Access to a deep labor pool and robust consumer population also makes the region a superior industrial location.

According to Cushman & Wakefield’s latest industrial market report, the Inland Empire West submarket had a vacancy rate of 5.4% in Q1 2024, representing the tightest submarket in the broader Inland Empire market. Additionally, IEW achieved nearly 1 million square feet of positive net absorption (occupancy growth) in the first quarter of 2024.

By Press Release

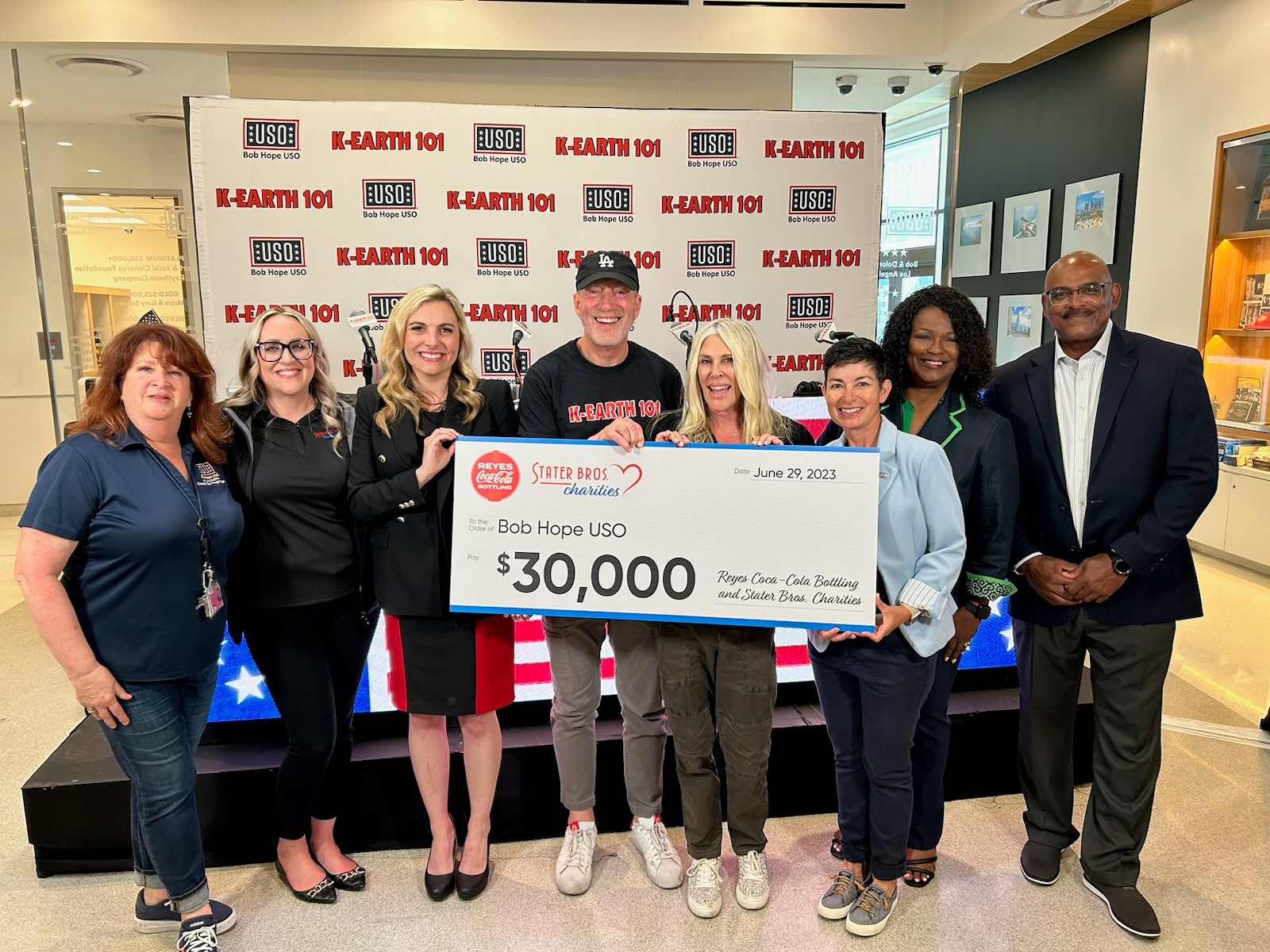

Stater Bros. Charities and Reyes Coca-Cola Bottling Give Back to Military Families

Stater Bros. Charities, the philanthropic arm of Stater Bros. Markets, partnered with Reyes Coca-Cola Bottling again this year for their Give Back program during National Military Appreciation Month. The program ran for the entire month of May, during which Reyes Coca-Cola Bottling committed to donating $0.25 per eligible product purchased to the Bob Hope USO. Reyes Coca-Cola Bottling donated $15,000, and Stater Bros. Charities matched their donation for a total contribution of $30,000.

A check presentation occurred during a K-EARTH 101 radiothon benefiting the Bob Hope USO. The radiothon took place at the Bob Hope USO at LAX (Los Angeles International Airport) on June 29, 2023, where Stater Bros. Charities and Reyes Coca-Cola Bottling presented Bob Hope USO with a $30,000 check.

Bob Hope USO’s mission is to strengthen America’s military service members by keeping them connected to family, home and country, throughout their service to the nation. The Give Back program is a unique opportunity to show gratitude and support to the brave men and women who risk their lives for our freedoms and to care for their families while they are away from home on deployment.

“Stater Bros. Markets has a long history of supporting veterans, service members, and their families,” said Danielle Oehlman, Director, Stater Bros. Charities. “We are so pleased to partner with our friends at Reyes Coca-Cola Bottling and the USO to give back to those who have given so much for us.”

Lorin Stewart, President, USO West Region, said, “We are deeply grateful to Stater Bros. Charities and Reyes Coca-Cola Bottling for being sustaining partners of the USO. The Give Back program embodies the essence of the USO mission by enabling the community at large to come together to support and give thanks to our armed forces and their brave military families in an impactful way.”

Funds will support the Bob Hope USO and USO San Diego Center operations, including programs and services that strengthen the social, mental, physical, and emotional well-being of local military service members, their families, and their communities.

By Press Release

BDK Logistics Intelligence Fully Leases 114,190 SF Industrial Facility in Corona, CA

Cushman & Wakefield represents landlord in lease in SoCal’s Inland Empire

Cushman & Wakefield announced that BDK Logistics Intelligence, Inc. has signed a lease for an entire 114,190-square-foot industrial facility at 1161 Olympic Drive in Corona, California. Situated in Southern California’s renowned Inland Empire, the building is owned by Monterey Rancho Mirage, LLC, which was represented by Brett Lockwood and Rick Ellison of Cushman & Wakefield in the transaction.

“We are pleased to welcome BDK to the property as a quality industrial tenant that is expanding its presence in the market, which it also currently occupies multiple warehouse facilities,” said Director Brett Lockwood. “Our client was instrumental in helping this deal transact as there were many variables that needed to be navigated which led to this lease coming together quickly and successfully.”

1161 Olympic Drive is a quality freestanding building situated on ±4.8 acres and features 20 dock high loading doors. The property is conveniently located off Interstate 15 near the confluence of SR 91 and is proximate to the extensive freeway network traversing the entire Greater Los Angeles region and into other major markets in and out of state.

According to Cushman & Wakefield’s latest Q2-2023 quarterly report, the Inland Empire industrial market posted an overall vacancy of 3.4% and has recorded more than 2.7 million square feet of positive net absorption through the first half of 2023.

-

Technology4 months ago

Technology4 months agoLA Tech Week Highlights Southern California’s Expanding Tech Ecosystem

-

Entertainment3 months ago

Entertainment3 months agoROI: Return on Insanity—Lucha VaVoom’s High-Yield Investment in the Pomona Arts Colony

-

Bizz Buzz2 months ago

Bizz Buzz2 months agoRegency Centers Unveils Oak Valley Village: A New Retail Hub Coming to Beaumont, CA

-

Food & Lifestyle4 months ago

Food & Lifestyle4 months agoFogo de Chão Heats Up Rancho Cucamonga Dining Scene

-

Travel & Tourism2 months ago

Travel & Tourism2 months agoFly Ontario, Calif., to Honolulu aboard Southwest Airlines starting in June

-

Transportation2 months ago

Transportation2 months agoRegional Leaders Launch “Coalition for Our Future” to Advance Urgent Safety Solutions for I-15 Corridor