Opinion

Walmart Helps Local Food Banks Feed California’s Estimated 4,354,400 Food Insecure Individuals Through Food Donations and “Fight Hunger. Spark Change.” Campaign

Approximately 11% of state’s population consistently struggles to get enough to eat; research shows hunger impacts learning, health, and productivity

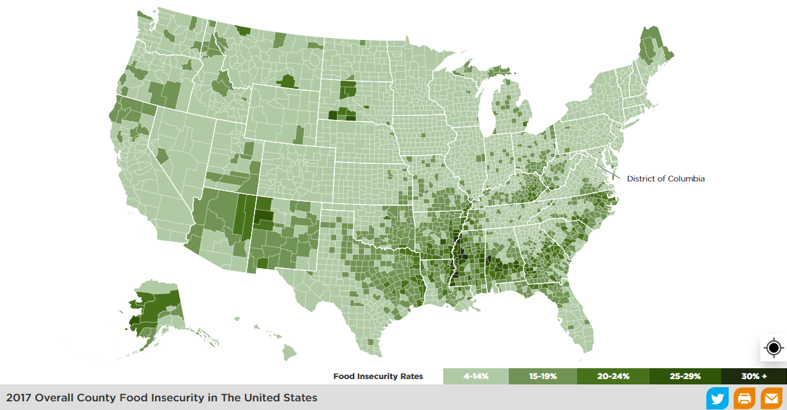

Image courtesy of Feeding America

Inland Empire, Calif., September 26, 2019 – While food insecurity is more prevalent in some parts of the country, the reality is that it exists in all communities. According to the US Department of Agriculture, nearly 40 million people face hunger in the U.S., including an estimated 4,354,400 individuals in California.

Walmart is deeply committed to fighting hunger and, as part of its efforts, collaborates with Feeding America®, the nation’s largest domestic hunger-relief organization, year-round to support their network of 200-member food banks and 60,000 food pantries and meal programs nationwide.

This year, through the retailer’s spring “Fight Hunger. Spark Change.” campaign, Walmart and Sam’s Club customers and associates raised more than $1,298,198 for California food banks, helping them provide healthy, nutritious meals to individuals and families struggling to get enough to eat.

Since 2014, the “Fight Hunger. Spark Change.” campaign has helped raise more than $5,269,689 for California food banks, helping secure more than 1 billion meals* for food banks nationwide. In 2019 in the Inland Empire and Indio, Walmart and its partners donated $164,844 to Feeding America Riverside | San Bernardino Counties Food Bank and $43,419 to Find Food Bank.

“Fighting hunger in our communities is extremely important to our stores, clubs and distribution centers, and Walmart as a company. Together with our customers, associates and suppliers, we are making strides toward hunger relief,” said Todd Siron, Walmart regional vice president for California. “We’re proud to be able to provide our local food banks with the support they need to truly make a difference in the lives of the families that rely upon them.”

In addition to monetary contributions, retail food donations are also an important part of Feeding America’s strategy for fighting hunger, accounting for the largest single source of meals the organization provided to people facing hunger last year.

In 2018, 1.4 billion meals – 32.5% of total meals provided by Feeding America partners—resulted from retail food donations. In California last year Walmart stores, Sam’s Clubs, and distribution centers donated more than 28 million lbs. of food to California food banks and affiliated pantries, resulting in thousands of meals for California families and individuals.

“Every day, Feeding America member food banks see the impact that hunger has on children, families, seniors and communities. We encourage everyone to find their local food bank and take action to help end hunger,” said Claire Babineaux-Fontenot, CEO of Feeding America. “Community support is essential to helping our neighbors in need and we are tremendously grateful to Walmart, Sam’s Club and their dedicated suppliers, associates and customers for their commitment to helping people who struggle to put food on their tables.”

Hunger can affect individuals from all walks of life, but some populations are more at risk. In California, children are one of the most vulnerable groups to food insecurity. According to Feeding America, hungry children are more likely to be hospitalized and face higher risks of health conditions like anemia and asthma. As they grow up, kids struggling to get enough to eat are more likely to have problems in school and other social situations.

As Hunger Action Month comes to a close on September 30, Walmart and Feeding America want to remind everyone that every action counts in the fight against hunger. Individuals can take action today to help fight hunger in their communities by volunteering their time or donating to any of the 200-member food banks or 60,000 food pantries and meal programs that comprise the Feeding America network. Go to www.hungeractionmonth.com to learn more and find a local Feeding America partner near you. Learn more about what Walmart and the Walmart Foundation are doing to help in these efforts at Walmart.org.

Walmart Inc. (NYSE: WMT) helps people around the world save money and live better – anytime and anywhere – in retail stores, online and through their mobile devices. In California, we serve customers at 303 retail units and online through Walmart Online Grocery, http://Walmart.com and our family of brands. We are proud to employ 91,124 associates in California. Walmart supports local businesses, spending $24 billion with California suppliers in FYE18 and supporting 257,706 California supplier jobs. Walmart continues to be a leader in employment opportunity, sustainability, and corporate philanthropy. In FY18, Walmart and the Walmart Foundation contributed more than $61 million in cash and in-kind donations to local nonprofits in California and our California associates volunteered more than 39 thousand hours with local causes. Additional information about Walmart can be found by visiting our corporate.walmart.com, and our Facebook, Twitter, Pinterest, Instagram channels.

About Feeding America

Feeding America® is the largest hunger-relief organization in the United States. Through a network of 200 food banks and 60,000 food pantries and meal programs, we provide meals to more than 46 million people each year. Feeding America also supports programs that prevent food waste and improve food security among the people we serve; educates the public about the problem of hunger; and advocates for legislation that protects people from going hungry. Individuals, charities, businesses and government all have a role in ending hunger. Donate. Volunteer. Advocate. Educate. Together we can solve hunger. Visit www.feedingamerica.org, find us on Facebook or follow us on Twitter.

*$1 helps provide at least 10 meals secured by Feeding America® on behalf of member food banks. This meal calculation is updated annually based on fiscal year financial and operational results. Campaign dates: 4/22/19 – 5/20/19.

Opinion

Ontario International Airport Welcomes Avelo Airlines with New Nonstop Service to Sonoma County

Expansion Connects Southern California Travelers to Northern California’s Premier Wine Destination

Ontario International Airport (ONT) continues its impressive growth trajectory with the recent announcement from Avelo Airlines about their exclusive nonstop service to Sonoma County and Northern California’s renowned wine country. Starting October 10, the service will operate twice weekly on Thursdays and Sundays, connecting travelers directly to the Charles M. Schulz Sonoma County Airport (STS).

Streamlined Travel Experience

Passengers choosing Ontario International Airport are set to benefit immensely, not just from the expanded destination choices but also from the significant time savings associated with flying out of ONT. Known for its convenience and efficiency, ONT offers a more relaxed and hassle-free travel experience compared to larger, more congested airports. The smaller scale and thoughtful layout of ONT allow passengers to navigate check-ins, security, and boarding processes much more quickly, reducing the stress often associated with air travel.

Local Impact and Convenience

“Atif Elkadi, Chief Executive Officer of the Ontario International Airport Authority, highlighted the benefits of the new service, stating, “We are thrilled to add Avelo Airlines to our family of air carriers as we continue to provide exciting new destinations and travel options for the millions of Southern Californians who have made ONT their airport of choice.”

ONT’s strategic location and accessibility play a crucial role in its popularity. Situated in the heart of Southern California’s Inland Empire, the airport is conveniently reachable for residents from San Bernardino to Riverside and the surrounding suburbs. The airport’s proximity to major freeways reduces travel time to the airport itself, which is a significant advantage for local residents and businesses.

Enhanced Access to Northern California

Andrew Levy, Founder and CEO of Avelo Airlines, expressed enthusiasm about the new route, saying, “We are thrilled to announce our new nonstop service from Ontario to the Bay Area/Sonoma County, offering travelers a convenient, reliable, and affordable way to one of the most beautiful and vibrant regions in Northern California.”

Jon Stout, STS Airport Manager, also noted the mutual benefits of the new connection, “It’s fantastic to see Avelo connect Sonoma County with Ontario. This new route will bring a new level of convenience for our local residents and our neighbors in the Inland Empire.”

ONT’s continued expansion and the addition of new routes like the one to Sonoma County reflect its role as a pivotal hub in the region. With the airport on track to exceed 7 million passengers this year and recent records showing more than 650,000 passengers in June alone, ONT is setting new benchmarks in serving the community.

A Gateway to Growth

With world-class facilities and a commitment to excellent customer service, Ontario International Airport is rapidly becoming the gateway of choice for travelers seeking both domestic and international connections. Elkadi proudly asserts, “With our world-class facilities, great amenities, and unparalleled customer experiences, we are proud to connect the world to one of the most dynamic population and economic centers in the country.”

As ONT continues to expand its services and streamline travel experiences, it solidifies its position not just as a transport hub but as a significant contributor to the economic vitality of the Inland Empire.

Opinion

Surge in Unemployment Among California Youth Linked to Minimum Wage Hikes

“We have to stop touting the minimum wage as a completely harmless policy, or as some kind of remedy for poverty and income inequality… it is neither.”

In the past 18 months, California’s unemployment rate has jumped to the highest in the nation and a new analysis by Beacon Economics suggests that this peculiar increase could be a direct result of the state’s recent minimum wage hikes. Most concerning, according to the report, is that the current unemployment effect is specifically harming some of California’s most vulnerable residents—the state’s youth.

The new report highlights the fact that 90% of newly unemployed Californians over the past year and a half are under the age of 35 with the hardest hit group being teenagers. “This loss of youth work opportunity carries with it real long-run harm,” said Christopher Thornberg, Founding Partner of Beacon Economics and co-author of the new analysis. “It not only denies younger workers a critical source of income it deprives them of work experience that has been empirically shown to improve their chances of long-run success.”

While the recent rise in unemployment in California has occurred in tandem with the state’s minimum wage hikes, the relationship likely extends beyond mere correlation. According to the analysis, the jump in unemployment is incongruous with other measures of the California economy, which have continued to expand at a respectable rate. In fact, both output and household income in the state are robust and growing either faster than or similar to the nation overall. Yet, the unemployment rate in the United States as a whole has barely budged in the past 24 months.

And there is yet another anomaly: throughout the recent rise in unemployment, there has been no corresponding increase in unemployment insurance claims. If laid off tech and entertainment industry workers were driving California’s higher unemployment rate, it would almost certainly be reflected, at least to some degree, in UI claims, according to the analysis.

“For far too long, researchers and advocates alike have held up the minimum wage as a harmless and effective policy remedy for poverty and income inequality, but it is neither of those things,” said Thornberg. “Evidence has shown us that minimum wages don’t do much to address the ills they are intended to correct, but carry a substantial cost, particularly for our state’s future workers.”

Although well intentioned, Thornberg, and co-author Niree Kodaverdian, argue that higher minimum wages cause prices to increase, which end up reducing real incomes for lower-skilled workers. Available data and past empirical studies show that wage floors do very little to divert income from higher income workers to lower income ones, which is how minimum wage laws are typically characterized by proponents.

The specific effect on youth is caused because as labor costs go up relative to other inputs, employers who might have used lower-skilled, entry level workers, such as teenagers, move towards hiring older, more experienced workers, according to the analysis. The idea is that if an employer is legally obligated to pay a higher wage, they will naturally hire more skilled and productive workers to offset higher labor costs. Since those under age 25 make up nearly half of minimum wage workers, this restructuring disproportionally affects the state’s youth.

The report firmly acknowledges the need for policies to help alleviate the strain on lower income households in pricey California but argues that this particular policy remedy doesn’t work as intended, and when pushed too far, can inflict real harm on some of the state’s most vulnerable residents. Better policy options, according to the authors, include the Earned Income Tax Credit, early childhood education, and increased training for lower-skilled adults.

The full analysis can be found here.

Health & Wellness

Conquering Hanger: Smart Strategies for Balanced Blood Sugar

Stay Energized and Focused with These Proactive Tips for Managing Hunger and Mood

Wellness Tips By Sarah Goudie, Nutrition Expert & Guest Writer for IEBJ

We’ve all been there: mornings rushed, constant pivots throughout the day, and suddenly it’s 7 pm with no thought given to food. Looking back on those moments, we all know what we resort to when we’re hangry.

Irritable. Scatterbrained. Shaky. Weak. Reduced impulse control. Tanked.

It’s simply the connection between our stomach and brain, as blood sugar levels can affect the release of hormones like adrenaline and cortisol, the fight or flight and stress hormones.

So, let’s address this blood sugar regulation/hangry cycle by taking care of ourselves in a few different ways.

- Prioritize Protein and Fat Before Your Morning Coffee: Your first meal sets the tone for the day ahead. Starting with protein before your coffee or favorite pastry can help stabilize blood sugar levels and provide satisfaction and sustenance. A handy tip: prepare a batch of hard-boiled eggs or protein pancakes on your day off for convenient grab-and-go options before you head out. Trust me, cold protein pancakes make for a quick and nutritious bite on your way to work! (Try the recipe below!)

- Opt for Balanced Meals: When you have a chance to eat, even if it’s not your ideal meal, prioritize finishing your protein first, followed by your veggies and fruits. If you’re including simple carbohydrates, save those for the end of your meal. This meal sequencing helps regulate blood sugar levels and mood.

- Plan Ahead—Even Days in Advance: Sometimes, waking up 15 minutes earlier isn’t enough to ensure a nourishing breakfast and packed lunch. However, planning earlier in the week can alleviate the morning rush before you start your day. I often create a menu tailored to my work week, carefully considering seasonal foods and my personal goals. While meal prepping is fantastic if you have the time and enjoy leftovers, simply having a plan and doing the shopping can empower you and reassure you that your kitchen is stocked and ready.

- Slow Down: The quality of the foods we eat is important (think locally sourced, sustainable, clean), but so is the timing of our meals, as well as our mood and our focus while eating. Be intentional about meal times—sit down, step away from your desk, TV, or phone, and fully immerse yourself in the experience of eating. Many times, we eat quickly without being mindful. If you must eat on the go, find a quiet spot, whether it’s a park bench or pulled over in your car. Take the time to see, smell, and taste your food.

- SNACK SMART: This last tip is bolded for good reason—it has been a lifesaver for me countless times. Pack snacks. Every day. ESPECIALLY WHEN TRAVELING. We never know what the day will bring, so we must be prepared when we can’t access a full meal. Some of my favorite go-to snacks include “That’s It” bars, “RX” bars, a handful of macadamia nuts, or Paleo Valley protein sticks…not to mention my favorite reusable water bottle (complete with a straw designed to fit perfectly in my car cup holder). Being armed with snacks containing essential nutrients (fat, carbs, protein, and fiber) will help you navigate those moments when you’re tempted to make a fast food run.

*On the topic of fast food: Stay tuned for next month’s article, where I’ll unveil my top picks for healthier alternatives on those unavoidable drive-thru days!

Leaning into these proactive steps can revolutionize your approach to mindful fuel for your body. Embracing protein-rich breakfasts, balanced meal strategies, proactive planning, mindful eating habits, and smart snacking choices nourishes your body. It cultivates a deeper connection with your food and overall well-being. You can take charge of your dietary journey, one thoughtful bite at a time, and savor the rewards of a healthier, more vibrant life.

Check out my favorite protein pancake recipe!

- Servings: 6 small pancakes

- 1 large banana

- 2 large eggs

- 1/2 tsp cinnamon

- 1 tablespoon coconut oil for pan

- 1 scoop of your preferred protein powder

- 1. Preheat skillet

- 2. Blend ingredients above

- 3. Use the coconut oil to prep the pan

- 4. Cook till golden brown

- 5. Serve warm, and add some fun toppings! My go-to toppings are hemp seeds, fresh seasonal fruit, a scoop of almond butter, and a drizzle of honey.

-

Technology4 months ago

Technology4 months agoLA Tech Week Highlights Southern California’s Expanding Tech Ecosystem

-

Bizz Buzz2 months ago

Bizz Buzz2 months agoRegency Centers Unveils Oak Valley Village: A New Retail Hub Coming to Beaumont, CA

-

Entertainment3 months ago

Entertainment3 months agoROI: Return on Insanity—Lucha VaVoom’s High-Yield Investment in the Pomona Arts Colony

-

Food & Lifestyle4 months ago

Food & Lifestyle4 months agoFogo de Chão Heats Up Rancho Cucamonga Dining Scene

-

Travel & Tourism2 months ago

Travel & Tourism2 months agoFly Ontario, Calif., to Honolulu aboard Southwest Airlines starting in June

-

Transportation2 months ago

Transportation2 months agoRegional Leaders Launch “Coalition for Our Future” to Advance Urgent Safety Solutions for I-15 Corridor