By Press Release

Ontario International Airport freight shipments up nearly 30% in June, 20% YTD; passenger levels improve

Freight shipments at Ontario Airport continued to soar in June

July 16, 2020 — Air freight shipments increased by nearly 30% in June and 20% in the first half of the year at Ontario International Airport (ONT), the result of increased reliance on e-commerce as Californians continue to observe safer-at-home orders and turn to online shopping for many household supplies.

Freight shipments totaled more than 79,000 tons in June, the fourth straight month that ONT experienced freight tonnage gains of 22% or more. From January through June, ONT processed 422,000 tons, one-fifth more than the 351,000 tons handled in the first six months of last year.

“Ontario continues to be a focal point in the global supply chain that runs through Southern California, and a main reason why our region’s economy continues to weather the current recession comparatively well,” said Mark Thorpe, chief executive officer of the Ontario International Airport Authority. “Month after month, Ontario Airport and our airline partners have demonstrated that our people and facilities are up to the task of shouldering an increasingly heavier workload, especially during this time of uncertainty.”

Freight shipments through ONT were up 12% by volume in February year-over-year, but in March, as the impact of the Covid-19 pandemic was felt across the aviation industry, freight tonnage climbed 22%, followed by increases of 26% in April and 24% in May.

| Air cargo (tonnage) | June 2020 | June 2019 | % Change | YTD 2020 | YTD 2019 | % Change |

| Freight | 79,152 | 61,163 | 29.41% | 422,062 | 351,068 | 20.2% |

| 1,628 | 1,775 | -8.26% | 9,146 | 13,582 | -32.7% | |

| Total | 80,780 | 62,938 | 28.35% | 431,208 | 364,651 | 18.3% |

The pandemic continued to depress passenger volume down in June, though at levels not as low as recent months. The number of ONT travelers declined by 93% in April and 85% in May.

In June, the number of ONT air travelers totaled 142,000, a 70% decrease compared to June 2019 yet twice as many as May of this year. More than 140,300 passengers were aboard domestic flights with the remaining 1,700 being international customers, another encouraging note since there were no international passengers at ONT in April and May.

Over the first half of 2020, ONT passengers totaled more than 1.3 million, which was 48% lower than the same period in 2019. Domestic passenger volume was more than 1.2 million, a drop of 47.5%, while international travelers numbered 65,700, a decrease of 55%.

| Passenger Totals | June 2020 | June 2019 | % Change | YTD 2020 | YTD 2019 | % Change |

| Domestic | 140,328 | 451,211 | -68.9% | 1,283,750 | 2,445,924 | -47.5% |

| International | 1,701 | 26,470 | -93.5% | 65,761 | 148,438 | -55.7% |

| Total | 142,029 | 477,681 | -70.2% | 1,349,511 | 2,594,362 | -48.0% |

“Freight shipments continue to drive commercial activity at Ontario, which is always a point of pride, particularly this year,” Thorpe said. “With ample room for growth, we expect Ontario will remain a magnet for economic activity in Southern California, and we anticipate considerable travel demand growth when passengers resume more normal business and leisure travel routines.”

By Press Release

Stockbridge Acquires 540,478 SF Inland Empire Industrial Portfolio for $142MM

San Francisco based Stockbridge acquires 100% leased assets in premier IE West location

Cushman & Wakefield’s EDSF also sources acquisition financing for transaction

Cushman & Wakefield announced the firm has arranged the sale of a core industrial portfolio totaling 540,478 square feet in Southern California’s premier Inland Empire West (IEW) submarket. The portfolio consists of two freestanding Class A buildings located a few miles apart at 3351 E Philadelphia St and 4450 E Lowell St in the city of Ontario. The buildings are 100% leased to prominent tenants in the distribution and retail industries.

San Francisco based Stockbridge acquired the two-property portfolio from Principal Asset ManagementSM a global financial and investment management firm. The portfolio sold for $142.25 million.

Jeff Chiate, Jeffrey Cole, Rick Ellison, and Matt Leupold of Cushman & Wakefield’s National Industrial Advisory Group—West represented the seller in the transaction. The firm’s Phil Lombardo, Chuck Belden and Andrew Starnes also provided leasing advisory.

Additionally, a Cushman & Wakefield Equity, Debt & Structured Finance (EDSF) team of Rob Rubano, Brian Share, Joseph Lieske, Max Schafer, and Becca Tse collaborated in sourcing acquisition financing for the transaction.

“Stockbridge has acquired an institutional-quality industrial portfolio with a phenomenal infill location combined with strong tenancy and premium distribution features and functionality. Both properties have maintained a historical occupancy of 100% for nearly a decade speaking to the tenant demand for industrial buildings of this quality and location,” said Jeff Chiate, Executive Vice Chair. “Additionally, with current rents below market rate, the buyer has a compelling mark-to market opportunity along with existing durable cash flow, providing a variety of value-add strategies.”

The properties offer convenient access to Southern California’s robust freeway network and other vital nodes of transit such as Ontario International Airport, the Los Angeles & Long Beach Ports, and LAX International Airport (60 miles). Access to a deep labor pool and robust consumer population also makes the region a superior industrial location.

According to Cushman & Wakefield’s latest industrial market report, the Inland Empire West submarket had a vacancy rate of 5.4% in Q1 2024, representing the tightest submarket in the broader Inland Empire market. Additionally, IEW achieved nearly 1 million square feet of positive net absorption (occupancy growth) in the first quarter of 2024.

By Press Release

Stater Bros. Charities and Reyes Coca-Cola Bottling Give Back to Military Families

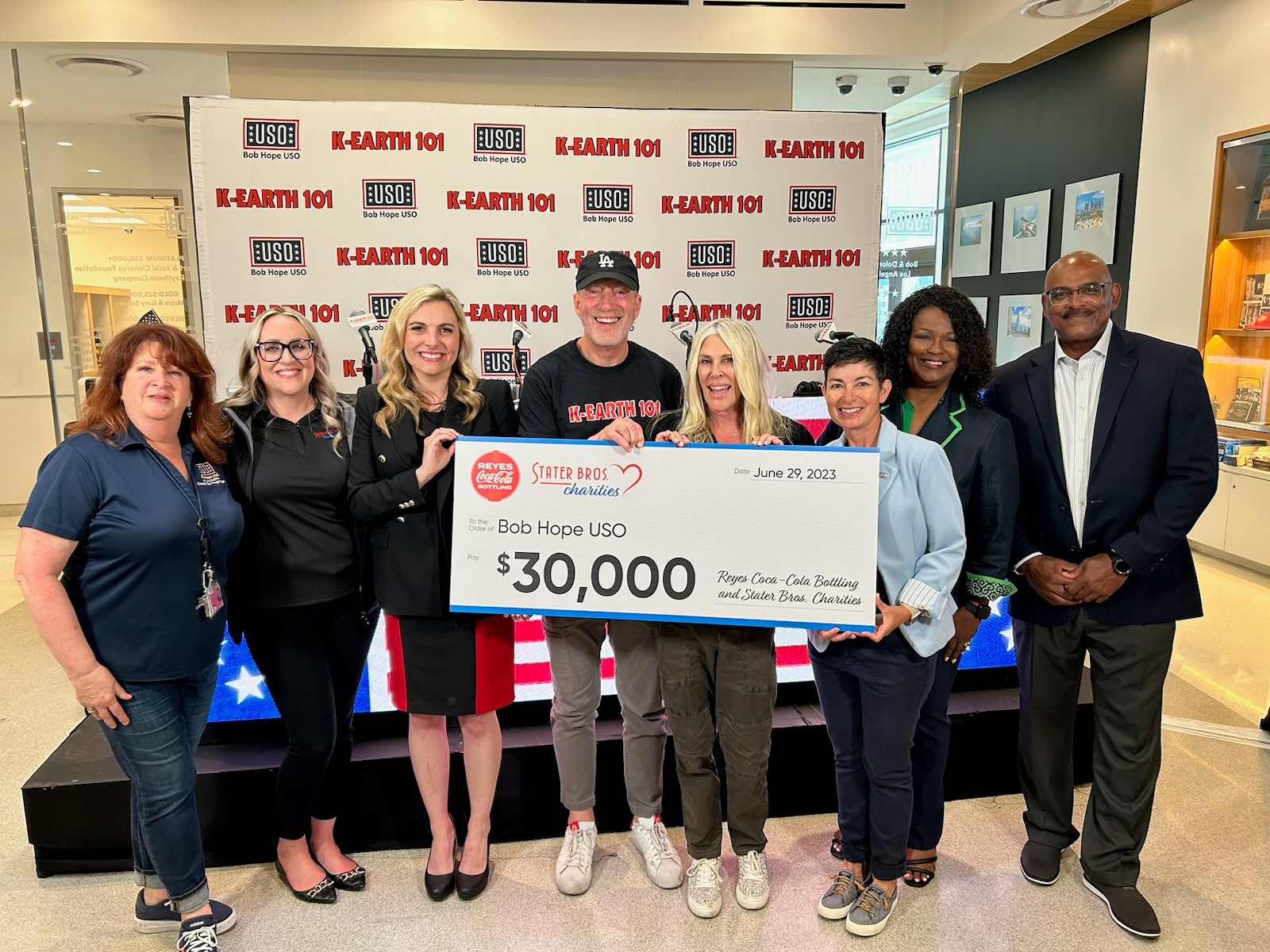

Stater Bros. Charities, the philanthropic arm of Stater Bros. Markets, partnered with Reyes Coca-Cola Bottling again this year for their Give Back program during National Military Appreciation Month. The program ran for the entire month of May, during which Reyes Coca-Cola Bottling committed to donating $0.25 per eligible product purchased to the Bob Hope USO. Reyes Coca-Cola Bottling donated $15,000, and Stater Bros. Charities matched their donation for a total contribution of $30,000.

A check presentation occurred during a K-EARTH 101 radiothon benefiting the Bob Hope USO. The radiothon took place at the Bob Hope USO at LAX (Los Angeles International Airport) on June 29, 2023, where Stater Bros. Charities and Reyes Coca-Cola Bottling presented Bob Hope USO with a $30,000 check.

Bob Hope USO’s mission is to strengthen America’s military service members by keeping them connected to family, home and country, throughout their service to the nation. The Give Back program is a unique opportunity to show gratitude and support to the brave men and women who risk their lives for our freedoms and to care for their families while they are away from home on deployment.

“Stater Bros. Markets has a long history of supporting veterans, service members, and their families,” said Danielle Oehlman, Director, Stater Bros. Charities. “We are so pleased to partner with our friends at Reyes Coca-Cola Bottling and the USO to give back to those who have given so much for us.”

Lorin Stewart, President, USO West Region, said, “We are deeply grateful to Stater Bros. Charities and Reyes Coca-Cola Bottling for being sustaining partners of the USO. The Give Back program embodies the essence of the USO mission by enabling the community at large to come together to support and give thanks to our armed forces and their brave military families in an impactful way.”

Funds will support the Bob Hope USO and USO San Diego Center operations, including programs and services that strengthen the social, mental, physical, and emotional well-being of local military service members, their families, and their communities.

By Press Release

BDK Logistics Intelligence Fully Leases 114,190 SF Industrial Facility in Corona, CA

Cushman & Wakefield represents landlord in lease in SoCal’s Inland Empire

Cushman & Wakefield announced that BDK Logistics Intelligence, Inc. has signed a lease for an entire 114,190-square-foot industrial facility at 1161 Olympic Drive in Corona, California. Situated in Southern California’s renowned Inland Empire, the building is owned by Monterey Rancho Mirage, LLC, which was represented by Brett Lockwood and Rick Ellison of Cushman & Wakefield in the transaction.

“We are pleased to welcome BDK to the property as a quality industrial tenant that is expanding its presence in the market, which it also currently occupies multiple warehouse facilities,” said Director Brett Lockwood. “Our client was instrumental in helping this deal transact as there were many variables that needed to be navigated which led to this lease coming together quickly and successfully.”

1161 Olympic Drive is a quality freestanding building situated on ±4.8 acres and features 20 dock high loading doors. The property is conveniently located off Interstate 15 near the confluence of SR 91 and is proximate to the extensive freeway network traversing the entire Greater Los Angeles region and into other major markets in and out of state.

According to Cushman & Wakefield’s latest Q2-2023 quarterly report, the Inland Empire industrial market posted an overall vacancy of 3.4% and has recorded more than 2.7 million square feet of positive net absorption through the first half of 2023.

-

Technology3 months ago

Technology3 months agoLA Tech Week Highlights Southern California’s Expanding Tech Ecosystem

-

Entertainment3 months ago

Entertainment3 months agoROI: Return on Insanity—Lucha VaVoom’s High-Yield Investment in the Pomona Arts Colony

-

Bizz Buzz2 months ago

Bizz Buzz2 months agoRegency Centers Unveils Oak Valley Village: A New Retail Hub Coming to Beaumont, CA

-

Food & Lifestyle4 months ago

Food & Lifestyle4 months agoFogo de Chão Heats Up Rancho Cucamonga Dining Scene

-

Travel & Tourism2 months ago

Travel & Tourism2 months agoFly Ontario, Calif., to Honolulu aboard Southwest Airlines starting in June

-

Transportation2 months ago

Transportation2 months agoRegional Leaders Launch “Coalition for Our Future” to Advance Urgent Safety Solutions for I-15 Corridor