Transportation

Unprecedented Disruption has Reshaped the Future of Logistics

Cushman & Wakefield releases 2021 Global Logistics Outlook

Cushman & Wakefield (NYSE: CWK), a leading global real estate services firm, has released its 2021 Global Logistics Outlook. The report analyzes key drivers affecting growth, global leasing dynamics and provides an outlook for the sector.

“The unprecedented disruption caused by COVID-19 pandemic and changing consumer behaviors has reshaped the future of the logistics industry by exposing global supply chain vulnerabilities and accelerating technological advances. As a result, a variety of global trends have emerged, propelling the sector forward in new ways,” said Cushman & Wakefield’s Jason Tolliver, Investor Lead, Logistics & Industrial Services, Americas.

North America

The North American industrial market experienced growth despite the COVID-19 pandemic wreaking havoc across the globe, as well as more local disruptions including hurricanes and wildfires. It has proven once again to be one of the most resilient asset types. Although North American new supply outpaced demand for the second year in a row, with 378 million square feet (msf) of completions, demand came in at 287 msf, surpassing 200 msf for the seventh consecutive year.

“COVID-19-induced lockdowns did cause a slight slowdown in demand in the first half of the year compared to prior years. However, even this combined with the large volume of supply has still not been enough to fully satiate tenant demand and to allow vacancy rates to begin to rise significantly,” said Tolliver. “Toward the end of 2020, North American industrial vacancy stood at 4.9%—just a 30 bps increase over 2019 and Canadian markets registered the lowest vacancy rates at 2.5% and Mexico City following at 3.0%.”

EMEA

“Europe’s logistics sector is grappling with supply constraints, stemming from a combination of a lack of developable land and strict planning regimes. In contrast to pre-Global Financial Crisis (GFC) when speculative development represented roughly 80% of new construction, post-GFC has been characterized by predominantly built-to-suit development that has led to severe supply shortages in most of Europe’s core logistics markets. As speculative construction resumed post-lockdowns more product came to market, pent up demand was released and leasing activity accelerated,” said Lisa Graham, Head of EMEA Industrial Research for Cushman & Wakefield.

Based on year-end data, vacancy continues to trend downward in most of Europe’s key logistics hubs. Vacancy of approximately 4% in Dutch and UK markets and vacancy hovering around 2% in Rotterdam, Lyon, Prague and Budapest, points to a severe lack of stock that, so far, a rise in speculative construction has been unable to alleviate. Furthermore, increased demand from e-retailers and 3PLs, as they expand their logistics footprint, has offset any vacancies created through tenant bankruptcies during 2020.

APAC

In broad terms, the regional industrial market remains resilient. Out of the 34 key markets covered within Asia Pacific, 15 are considered landlord-favorable with six being tenant favorable and the remaining 13 in neutral territory. The status quo has largely been maintained year-to-date, with only Singapore showing any significant change to becoming more tenant friendly, though this is restricted to certain parts of the industrial market. This is in stark contrast to the office sector within the region, which has seen a much more definitive shift towards more tenant-friendly conditions.

“Industrial rents have shown steady growth in the year-to-date in key Indian and South East Asian markets where rents in Delhi, Ho Chi Minh City, Kolkata, Jakarta and Hanoi have all increased by over 2.5%. Rents have been held broadly flat in Australia while they have seen a slight uptick of 2% in the Chinese logistics market, due to boosted demand from online shopping soaking up some of the vacancy,” said Dr. Dominic Brown, Global Head of Demographic Insights, APAC-lead for Cushman & Wakefield.

| Most Expensive | |||

| Rank | Country | Market | USD |

| SF/yr | |||

| 1 | UK | London | $ 24.90 |

| 2 | China | Hong Kong | $ 19.93 |

| 3 | U.S. | San Francisco Peninsula, CA | $ 18.25 |

| 4 | Switzerland | Geneva | $ 17.97 |

| 5 | Singapore | Singapore | $ 16.68 |

| 6 | Japan | Tokyo | $ 14.71 |

| 7 | Norway | Oslo | $ 14.68 |

| 8 | U.S. | San Francisco North Bay, CA | $ 14.62 |

| 9 | U.S. | Puget Sound – Eastside | $ 14.31 |

| 10 | Switzerland | Zurich | $ 13.97 |

| Least Expensive | |||

| Rank | Country | Market | USD |

| SF/yr | |||

| 1 | India | Hyderabad | $2.45 |

| 2 | India | Ahmedabad | $2.61 |

| 3 | Turkey | Izmir | $2.79 |

| 4 | Turkey | Ankara | $3.07 |

| 5 | India | NCR | $3.27 |

| 6 | India | Chennai | $3.41 |

| 7 | U.S. | Memphis, TN | $3.61 |

| 8 | India | Kolkata | $3.70 |

| 9 | Greece | Thessaloniki | $3.72 |

| 10 | U.S. | Columbus, OH | $3.95 |

“The global logistics sector not only showed resilience during the strict first half lockdowns but went on to benefit from consumer and business reactions to the pandemic during second half. Broadening e-commerce, both geographically and by product range, will be a key driver of new space demand over the next decade,” said Tolliver. “In a post-COVID-19 world, there will be greater focus on using real estate to leverage cost across the whole supply chain, better positioning businesses as they navigate a B2C business model, reshoring, inventory management, labor issues, transportation and ESG. Together, these factors will govern location strategy.”

Transportation

Brightline West Breaks Ground on America’s First High-Speed Rail Project Connecting Las Vegas to Rancho Cucamonga

Officials Hammer the First Spike Commemorating the Groundbreaking for Brightline West

Today, Brightline West officially broke ground on the nation’s first true high-speed rail system which will connect Las Vegas to Southern California. The 218-mile system will be constructed in the middle of the I-15 and is based on Brightline’s vision to connect city pairs that are too short to fly and too far to drive. Hailed as the greenest form of transportation in the world, Brightline West will run zero emission, fully electric trains capable of speeds of 200 miles per hour. Brightline West is a watershed project for high-speed rail in America and will establish the foundation for the creation of a new industry and supply chain. The project was recently awarded $3 billion in funding from President Biden’s Bipartisan Infrastructure Bill. The rest of the project will be privately funded and has received a total allocation of $3.5 billion in private activity bonds from USDOT.

The groundbreaking included remarks from U.S. Transportation Secretary Pete Buttigieg, Brightline Founder Wes Edens, Nevada Gov. Joe Lombardo, Sen. Catherine Cortez, Sen. Jacky Rosen, California Rep. Pete Aguilar, Senior Advisor to President Biden Steve Benjamin and Vince Saavedra of the Southern Nevada Building Trades. In addition, Nevada Reps. Dina Titus, Susie Lee and Steve Horsford and California Rep. Norma Torres joined the celebration. More than 600 people, including union representatives, project supporters and other state and local officials from California and Nevada, attended the event.

“People have been dreaming of high-speed rail in America for decades – and now, with billions of dollars of support made possible by President Biden’s historic infrastructure law, it’s finally happening,” said Secretary Buttigieg. “Partnering with state leaders and Brightline West, we’re writing a new chapter in our country’s transportation story that includes thousands of union jobs, new connections to better economic opportunity, less congestion on the roads, and less pollution in the air.”

“This is a historic project and a proud moment where we break ground on America’s first high-speed rail system and lay the foundation for a new industry,” said Wes Edens, Brightline founder. “Today is long overdue, but the blueprint we’ve created with Brightline will allow us to repeat this model in other city pairs around the country.”

CONSTRUCTION OF BRIGHTLINE WEST

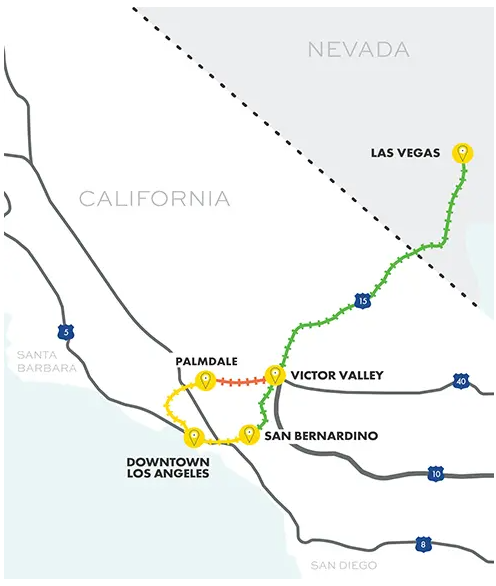

Brightline West’s rail system will span 218 miles and reach speeds of 200 mph. The route, which has full environmental clearance, will run within the median of the I-15 highway with zero grade crossings. The system will have stops in Las Vegas, Nev., as well as Victor Valley, Hesperia and Rancho Cucamonga, Calif.

The privately led infrastructure project is one of the largest in the nation and will be constructed and operated by union labor. It will use 700,000 concrete rail ties, 2.2 million tons of ballast, and 63,000 tons of 100% American steel rail during construction. Upon completion, it will include 322 miles of overhead lines to power the trains and will include 3.4 million square feet of retaining walls. The project covers more than 160 structures including viaducts and bridges. Brightline West will be fully Buy America Compliant.

STATIONS AND FACILITIES

Brightline West will connect Southern California and Las Vegas in two hours or almost half the time as driving. The Las Vegas Station will be located near the iconic Las Vegas Strip, on a 110-acre property north of Blue Diamond Road between I-15 and Las Vegas Boulevard. The site provides convenient access to the Harry Reid International Airport, the Las Vegas Convention Center and the Raiders’ Allegiant Stadium. The station is approximately 80,000 square feet plus parking.

The Victor Valley Station in Apple Valley will be located on a 300-acre parcel southeast of Dale Evans Parkway and the I-15 interchange. The station is intended to offer a future connection to the High Desert Corridor and California High Speed Rail. The Victor Valley Station is approximately 20,000 square feet plus parking.

The Rancho Cucamonga Station will be located on a 5-acre property at the northwest corner of Milliken Avenue and Azusa Court near Ontario International Airport. The station will be co-located with existing multi-modal transportation options including California Metrolink, for seamless connectivity to Downtown Los Angeles and other locations in Los Angeles, Orange, San Bernardino and Riverside Counties. The Rancho Cucamonga Station is approximately 80,000 square feet plus parking.

The Hesperia Station will be located within the I-15 median at the I-15/Joshua Street interchange and will function primarily as a local rail service for residents in the High Desert on select southbound morning and northbound evening weekday trains.

The Vehicle Maintenance Facility (VMF) is a 200,000-square-foot building located on 238 acres in Sloan, Nev., and will be the base for daily maintenance and staging of trains. This site will also serve as one of two hubs for the maintenance of way operations and the operations control center. More than 100 permanent employees will report on a daily basis once operations begin and will serve as train crews, corridor maintenance crews, or operations control center teammates. A second maintenance of way facility will be located adjacent to the Apple Valley station.

MARKET

The Las Vegas and Southern California travel market is one of the nation’s most attractive corridors with over 50 million trips between the region each year. Additionally, Las Vegas continues to attract visitors from around the world, with 4.7 million international travelers flying into the destination. The city dubs itself on being the world’s No. 1 meeting destination, welcoming nearly 6 million people to the Las Vegas Convention Center last year.

In California, approximately 17 million Southern California residents are within 25 miles of the Brightline West station sites. Studies show that one out of every three visits to Las Vegas come from Southern California.

ECONOMIC & ENVIRONMENTAL BENEFITS

Brightline West’s $12 billion infrastructure investment will create over $10 billion in economic impact for Nevada and California and will generate more than 35,000 jobs, including 10,000 direct union construction roles and 1,000 permanent operations and maintenance positions. The investment also includes over $800 million in improvements to the I-15 corridor and involves agreements with several unions for skilled labor. The project supports Nevada and California’s climate goals by offering a no-emission mobility option that reduces greenhouse gasses by over 400,000 tons of CO2 annually – reducing vehicle miles traveled by more than 700 million each year and the equivalent of 16,000 short-haul flights. The company will also construct three wildlife overpasses, in partnership with the California Department of Fish and Wildlife and Caltrans for the safe passage of native species, primarily the bighorn sheep.

BRIGHTLINE FLORIDA

Brightline’s first rail system in Florida connecting Miami to Orlando began initial service between its South Florida stations in 2018. In September 2023, Brightline’s Orlando station opened at Orlando International Airport, connecting South Florida to Central Florida. The company has plans to expand its system with future stops in Tampa, Florida’s Space Coast in Cocoa and the Treasure Coast in Stuart.

Transportation

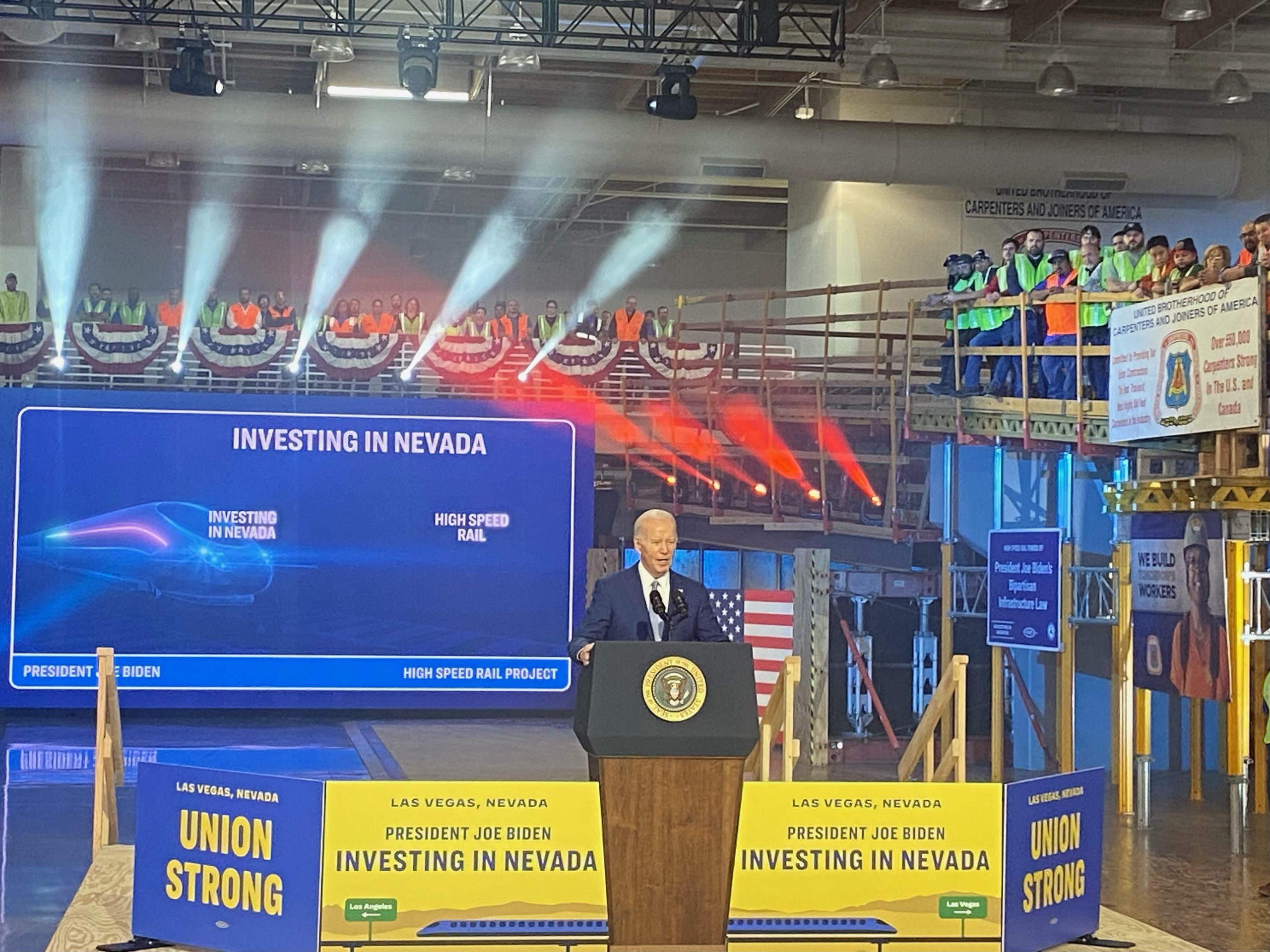

President Biden Joins Officials in Las Vegas to Announce $3B Grant for Nevada Department of Transportation for Brightline West

America’s First High-Speed Rail Project will Connect Las Vegas and Southern California

President Joe Biden joined elected officials from Nevada and California to formally announce that the Nevada Department of Transportation (NDOT) has received $3 billion in funding from the Federal-State Partnership for Intercity Passenger Rail Grant Program for Brightline West. Brightline West will connect Las Vegas and Southern California and will be the nation’s first true high-speed rail system. The project will also be the first to be built with American union labor. The fully-electric, zero-emission system will become one of the greenest forms of transportation in the U.S.

President Biden was joined by Nevada officials including Governor Joe Lombardo, Senators Jacky Rosen and Catherine Cortez Masto, Representatives Dina Titus, Susie Lee and Steven Horsford. Also in attendance were representatives from the High Speed Rail Labor Coalition and the Nevada Building Trades.

Brightline West’s modern, eco-friendly system will redefine train travel in America and connect two of the most iconic destinations: Las Vegas and Southern California. This 218-mile passenger rail service will reach speeds up to 200 mph with no grade crossings and the alignment is within the median of the I-15 highway. The system will feature three full-service stations in Las Vegas, Victor Valley and Rancho Cucamonga, Calif.

The Las Vegas station will include mobility connections and easy access to the Las Vegas Strip, the Raiders’ Allegiant Stadium and the Las Vegas Convention Center. The flagship Las Vegas station will be on 110 acres at the south end of Las Vegas Blvd. Brightline West’s California stations will include Victor Valley and Rancho Cucamonga, with direct connectivity via California Metrolink to key points in Los Angeles, such as Union Station.

Brightline West’s $12 billion project will bring widespread benefits including more than $10 billion in economic impact to Nevada and California. Economic studies show the project will create more than 35,000 (direct and indirect) jobs including 10,000 direct union construction jobs and nearly 1,000 permanent jobs for operations and maintenance. Brightline West’s investment also includes more than $800 million in roadway improvements to the I-15 corridor. Brightline West has agreements in place with several unions for the use of highly skilled union labor in critical jobs required to build, operate and maintain the project.

The project’s environmental benefits are equally impressive and designed to support Nevada and California’s climate strategies by promoting a no-emission mobility option that lowers greenhouse gasses by more than 400,000 tons of CO2 each year. The diversion of people from auto and air travel to Brightline West’s high-speed rail system reduces vehicle miles traveled by more than 700 million each year and 16,000 short haul flights annually.

The $3 billion grant award marks the largest in NDOT’s history and is the culmination of more than two decades of planning and coordination to build a high-speed rail line between Las Vegas and Southern California. NDOT, as the grant administrator, will continue to play an important oversight role as Brightline West constructs the rail system. Additionally, NDOT will be responsible for the design, construction, and oversight of any NDOT infrastructure that requires modification as a result of Brightline West’s work.

Transportation

Inland Empire Regional Chamber of Commerce Event to Spotlight Brightline West

Program will highlight what’s next for high-speed rail in the Inland Empire

High-Impact Event Alert

Brightline West will be featured during the Inland Empire Regional Chamber of Commerce’s “High-Speed Rail is Headed to the Inland Empire” event on Wednesday, January 11, from 11:00 a.m. – 1:30 p.m. at Jessie Turner Community Center in Fontana, CA, which the County of San Bernardino is a title sponsor. The program will feature an update on Brightline West, including the project’s role in regional and statewide connectivity, its benefits to the community, what to expect in 2023, and how the public can stay engaged.

Featured panelists for the program are:

- Fiona Ma, Treasurer, State of California

- Ray Wolfe, Executive Director, San Bernardino County Transportation Authority

- Sarah Watterson, President, Brightline West

- Edward Ornelas, Jr., President/CEO, Inland Empire Regional Chamber of Commerce

- Matt Burris, Deputy City Manager of Community Development, City of Rancho Cucamonga

Brightline is the only private provider of modern, eco-friendly, intercity passenger rail service in America. The company currently serves Miami, Aventura, Fort Lauderdale, Boca Raton, and West Palm Beach in Florida, with its Orlando station beginning service in 2023. Recognized by Fast Company as one of the Most Innovative Companies in travel, Brightline offers a guest-first experience designed to reinvent train travel and take cars off the road by connecting city pairs and congested corridors that are too close to fly and too long to drive. Brightline West will build on this award-winning service by connecting Las Vegas and Southern California, with stations in Las Vegas, Victor Valley, Hesperia, and Rancho Cucamonga, and connectivity to Metrolink’s regional rail network.

“This will transform transportation in Southern California and Las Vegas for generations by providing a fast and efficient connection that gets people out of their cars, reduces traffic congestion and decreases air pollution.” -Fiona Ma, California State Treasurer

KEY FACTS:

- Expected travel time is approx. 2 ¼ hours

- Our route is 2x faster than driving

- Zero-emission, electric train sets

- Expected top speed is 180 mph

- 400,000 tons of CO2 removed annually by reducing 3 million vehicles

- Connections to Metrolink and planned future connection to California High-Speed Rail in Palmdale

- Convenient station location on the Vegas strip (I-15)

For more information and to register for the event, click here.

-

By Press Release12 months ago

By Press Release12 months agoOntario Apartment Community Trades or $50.5 Million

-

By Press Release12 months ago

By Press Release12 months agoSRS Real Estate Partners’ National Net Lease Group Completes $3.3 Million Ground Lease Sale of a McDonald’s-Occupied Property Near Temecula, CA for a 3.48% Cap Rate

-

By Press Release12 months ago

By Press Release12 months agoHanley Investment Group Arranges Pre-Sale of New Dutch Bros Coffee Drive-Thru in Riverside County, Calif., for $1.9 Million

-

By Press Release12 months ago

By Press Release12 months agoNew McDonald’s Restaurant Opening In Indio CA!

-

Business12 months ago

Business12 months agoBeacon Economics Sets the Record Straight on the UCR Business Center Controversy

-

Bizz Buzz8 months ago

Bizz Buzz8 months agoHernandez resigns as County CEO; Snoke will continue filling in pending Board action