By Press Release

Birtcher Development LLC Acquires $17.6M, 20-Acre Site Adjacent to San Bernardino Airport

Fifth generation industrial developer to build 406,710-square-foot, 40-foot clear Airport Distribution Center

SAN BERNARDINO, Calif. (Jan. 20, 2020) – Birtcher Development LLC, a preeminent industrial real estate developer with five generations of family ownership, today announced the acquisition of a 20-acre land parcel fully entitled for the development of a spec 406,710-square-foot regional fulfillment and distribution center. Birtcher Development purchased the asset from 6th Street LLC for $17.6 million. It anticipates breaking ground on the project in spring 2020, and construction is slated for completion in Q4 2020.

Located in Southern California’s Inland Empire – one of the nation’s premier logistics hubs – the industrial project is three blocks away from the San Bernardino Airport and is accessible to Interstates 10 and 215, key transportation routes throughout the Inland Empire and across the country. With record-low vacancy rates – currently 3% in the Inland Empire as of Q3 2019 – this project is designed to satisfy the high demand for new and advanced high cube industrial warehouse space in the submarket.

“Given the logistics opportunities presented by the airport, convenient access to major trucking thoroughfares and excellent labor market, the demand for new, modern industrial space in the San Bernardino Airport submarket is incredibly high,” said Brooke Birtcher Gustafson, Birtcher Development LLC’s Managing Director. “Once delivered, standing at 40-clear height, this state-of-the-art facility will bring much needed high cube product to market during a time when the e-commerce boom is driving unprecedented industrial demand.”

The new rear-loaded warehouse facility will feature an 8-inch slab and 40-foot clear heights, resulting in 16-20% more pallet positions than the typical 36-foot warehouse. It will also include 65 dock high doors plus an additional 167 designated trailer stalls in a secured concrete truck yard; 259 auto parking spaces and two grade-level loading doors. Power for the site includes 4,000 AMP service (2,000 AMPs installed), 2.5% parabolic skylights and 100,000 kW/h/year of solar power that will be ready for tenant use.

“This is one of the fastest executed deals our company has ever done,” said Brian Barre, spokesperson for the seller. “The short due diligence process, quick close and seamless execution made it a pleasure to work with Birtcher Development LLC.”

Currently in an unimproved condition, the parcel is located on 6th St. between Lankershim Ave. and Sterling Ave., just two blocks from a planned $200 million air cargo logistics center that will house up to 16 aircrafts and generate nearly 4,000 jobs. In addition to serving as a central air cargo and distribution node, San Bernardino benefits from a robust labor market. This is attributable in large part to the aggressive logistics training programs offered by the San Bernardino County Unified School District and San Bernardino Valley College.

The project architect is HPA Architecture of Irvine. Eloy Covarrubias, Joe Werdein and Jeff Fritch of CBRE are representing Birtcher in securing a tenant for the facility.

Darla Longo, Barbara Perrier, Rebecca Perlmutter, Brett Hartzell, Eric Cox, Eloy Covarrubias, Jeff Fritch and Joe Werdein of CBRE served as brokers on the acquisition.

About Birtcher Development LLC

Newport Beach, California-based Birtcher Development LLC is a fifth generation, family industrial real estate company founded in 1939. Since its inception, Birtcher has acquired, managed or developed more than 65 million square feet as a result of more than 260 projects valued in excess of $7 billion dollars. The company develops speculative “Big Box” logistics warehouse facilities ranging from 100,000 square feet in the high-demand major metro infill markets to 1.5 million square feet in the highest-barrier-to-entry markets of the U.S. that also demonstrate the highest absorption. Learn more at Birtcher.com.

By Press Release

California Employment Expansion Continues But Still Trails Nation

Unemployment Rate Unchanged From Last Month But Remains Highest In U.S.

California’s labor market expansion hit its 50th month in the latest numbers, with total nonfarm employment in the state growing by a seasonally adjusted 22,500 positions in June, according an analysis released today by Beacon Economics. May’s gains were revised to 43,300 in the latest numbers, a 400 decrease from the preliminary estimate of 43,700.

Employment growth in California has trailed the nation in recent years. Since February 2020 (the start of the pandemic), total nonfarm employment in the state has grown 2.1% compared to a 4.2% increase nationally. California increased payrolls by 1.3% from June 2023 to June 2024, trailing the 1.7% increase nationally over the same period.

The state’s unemployment rate held steady at 5.2% in June, unchanged from the previous month, but remains the highest in the nation. California’s unemployment rate has jumped over the last year, and the newly unemployed are almost entirely younger worker (under age 35). Oddly, initial claims for unemployment insurance have remained stable over this period. Beacon Economics has connected the surge in youth unemployment to the state’s minimum wage hikes. An analysis of that phenomenon can be seen here.

California continues to struggle with its labor supply, although its workforce grew by 7,200 in June. Since February 2020, the state’s labor force has declined by -246,200 workers, a -1.3% drop. This is being driven largely by the housing shortage and the retirement of aging workers. In addition, the household survey has diverged from the payroll survey in recent years. In addition, the household survey has diverged from the payroll survey in recent years. Total nonfarm employment is up 2.2% over the last two years, according to the payroll survey, while in the household survey, household employment is down 0.3% over the same period.

“Notably, these two surveys are the basis of the monthly jobs estimates and their divergence could get worse next year when the survey sample is cut as a cost saving measure,” said Justin Niakamal, Regional Research Manager at Beacon Economics.

Industry Profile

- The Health Care sector led growth over the last year, with payrolls expanding by 141,700 or 5.3%. Other sectors posting strong gains over the last year were Government (60,200 or 2.3%), Leisure and Hospitality (32,100 or 1.6%), Education (14,900 or 3.7%), Other Services (14,500 or 2.5%), and Construction (11,900 or 1.3%).

- Information has led declines over the past year, with payrolls falling by 29,000, a -5.2% decrease. Other sectors with notable annual declines include Manufacturing (-25,900 or -1.9%), Finance and Insurance (-8,500 or -1.7%), and Management (-2,800 or -1.2%).

- At the industry level, growth was broad based during June. Health Care led gains during the month, with payrolls expanding by 6,500, an increase of 0.2% on a month-over-month basis. In addition, payrolls in Health Care are 14.2% above their pre-pandemic peak, the fastest growth among the state’s major industries.

- Other sectors posting strong gains during the month were Government (5,200 or 0.2%), Professional, Scientific, and Technical (4,700 or 0.3%), Wholesale Trade (4,200 or 0.6%), Information (4,000 or 0.8%), Transportation, Warehousing, and Utilities (3,800 or 0.5%), Retail Trade (1,800 or 0.1%), Leisure and Hospitality (1,500 or 0.1%), Finance and Insurance (1,300 or 0.3%), and Real Estate (900 or 0.3%).

- Payrolls decreased a handful of sectors in June. Education saw the largest decline with payrolls falling by -3,300, a contraction of -0.8% on a month-over-month basis. However, payrolls are still up 3.7% over the last year and have grown 6.0% since the start of the pandemic.

- Other sectors posting significant declines during the month were Manufacturing (-2,900 or -0.2%), Administrative Support (-2,900 or -0.3%), Other Services (-1,300 or -0.2%), Construction (-500 or -0.1%), and Management (-400 or -0.2%).

Regional Profile

- Regionally, job gains were led by Southern California. Los Angeles (MD) saw the largest increase, where payrolls grew by 13,400 (0.3%) during the month. The Inland Empire (4,800 or 0.3%), Orange County (4,800 or 0.3%), San Diego (2,000 or 0.1%), Ventura (700 or 0.2%), and El Centro (300 or 0.5%) also saw their payrolls jump during the month. Over the past year, El Centro (2.4%) has enjoyed the fastest job growth in the region, followed by the Inland Empire (1.9%), Ventura (1.4%), Orange County (1.2%), Los Angeles (MD) (1.1%), and San Diego (0.7%).

- In the Bay Area, the East Bay experienced the largest increase, with payrolls expanding by 1,800 (0.2%) positions in June. San Rafael (MD) (700 or 0.6%), Santa Rosa (700 or 0.3%), Vallejo (300 or 0.2%), and Napa (100 or 0.1%) also saw payrolls increase during the month. On the other hand, payrolls decreased in San Jose (-1,200 or -0.1%) during the month. Over the past 12 months, Vallejo (2.3%) has seen the fastest job growth in the region, followed by Santa Rosa (2.0%), Napa (2.0%), San Rafael (MD) (1.5%), the East Bay (1.1%), San Jose (0.4%), and San Francisco (MD) (-0.3%).

- In the Central Valley, Sacramento experienced the largest monthly increase as payrolls expanded by 2,100 (0.2%) positions in June. Payrolls in Fresno (900 or 0.2%), Bakersfield (800 or 0.3%), Merced (400 or 0.5%), Modesto (200 or 0.1%), Visalia (200 or 0.1%), and Yuba (100 or 0.2%) increased as well. Over the past year, Madera (4.7%) has had the fastest growth, followed by Yuba (4.2%), Merced (3.5%), Modesto (3.1%), Stockton (2.6%), Fresno (2.4%), Sacramento (2.3%), Hanford (2.1%), Visalia (1.7%), Redding (1.4%), Chico (1.2%), and Bakersfield (0.7%).

- On California’s Central Coast, Salinas (200 or 01%) added the largest number of jobs during the month. San Luis Obispo (100 or 0.1%) and Santa Barbara (100 or 0.1%) also saw payrolls increase. From June 2023 to June 2024, Santa Cruz (1.7%) has added jobs at the fastest rate, followed by Salinas (1.4%), San Luis Obispo (0.3%), and Santa Barbara (0.2%).

By Press Release

Stockbridge Acquires 540,478 SF Inland Empire Industrial Portfolio for $142MM

San Francisco based Stockbridge acquires 100% leased assets in premier IE West location

Cushman & Wakefield’s EDSF also sources acquisition financing for transaction

Cushman & Wakefield announced the firm has arranged the sale of a core industrial portfolio totaling 540,478 square feet in Southern California’s premier Inland Empire West (IEW) submarket. The portfolio consists of two freestanding Class A buildings located a few miles apart at 3351 E Philadelphia St and 4450 E Lowell St in the city of Ontario. The buildings are 100% leased to prominent tenants in the distribution and retail industries.

San Francisco based Stockbridge acquired the two-property portfolio from Principal Asset ManagementSM a global financial and investment management firm. The portfolio sold for $142.25 million.

Jeff Chiate, Jeffrey Cole, Rick Ellison, and Matt Leupold of Cushman & Wakefield’s National Industrial Advisory Group—West represented the seller in the transaction. The firm’s Phil Lombardo, Chuck Belden and Andrew Starnes also provided leasing advisory.

Additionally, a Cushman & Wakefield Equity, Debt & Structured Finance (EDSF) team of Rob Rubano, Brian Share, Joseph Lieske, Max Schafer, and Becca Tse collaborated in sourcing acquisition financing for the transaction.

“Stockbridge has acquired an institutional-quality industrial portfolio with a phenomenal infill location combined with strong tenancy and premium distribution features and functionality. Both properties have maintained a historical occupancy of 100% for nearly a decade speaking to the tenant demand for industrial buildings of this quality and location,” said Jeff Chiate, Executive Vice Chair. “Additionally, with current rents below market rate, the buyer has a compelling mark-to market opportunity along with existing durable cash flow, providing a variety of value-add strategies.”

The properties offer convenient access to Southern California’s robust freeway network and other vital nodes of transit such as Ontario International Airport, the Los Angeles & Long Beach Ports, and LAX International Airport (60 miles). Access to a deep labor pool and robust consumer population also makes the region a superior industrial location.

According to Cushman & Wakefield’s latest industrial market report, the Inland Empire West submarket had a vacancy rate of 5.4% in Q1 2024, representing the tightest submarket in the broader Inland Empire market. Additionally, IEW achieved nearly 1 million square feet of positive net absorption (occupancy growth) in the first quarter of 2024.

By Press Release

Stater Bros. Charities and Reyes Coca-Cola Bottling Give Back to Military Families

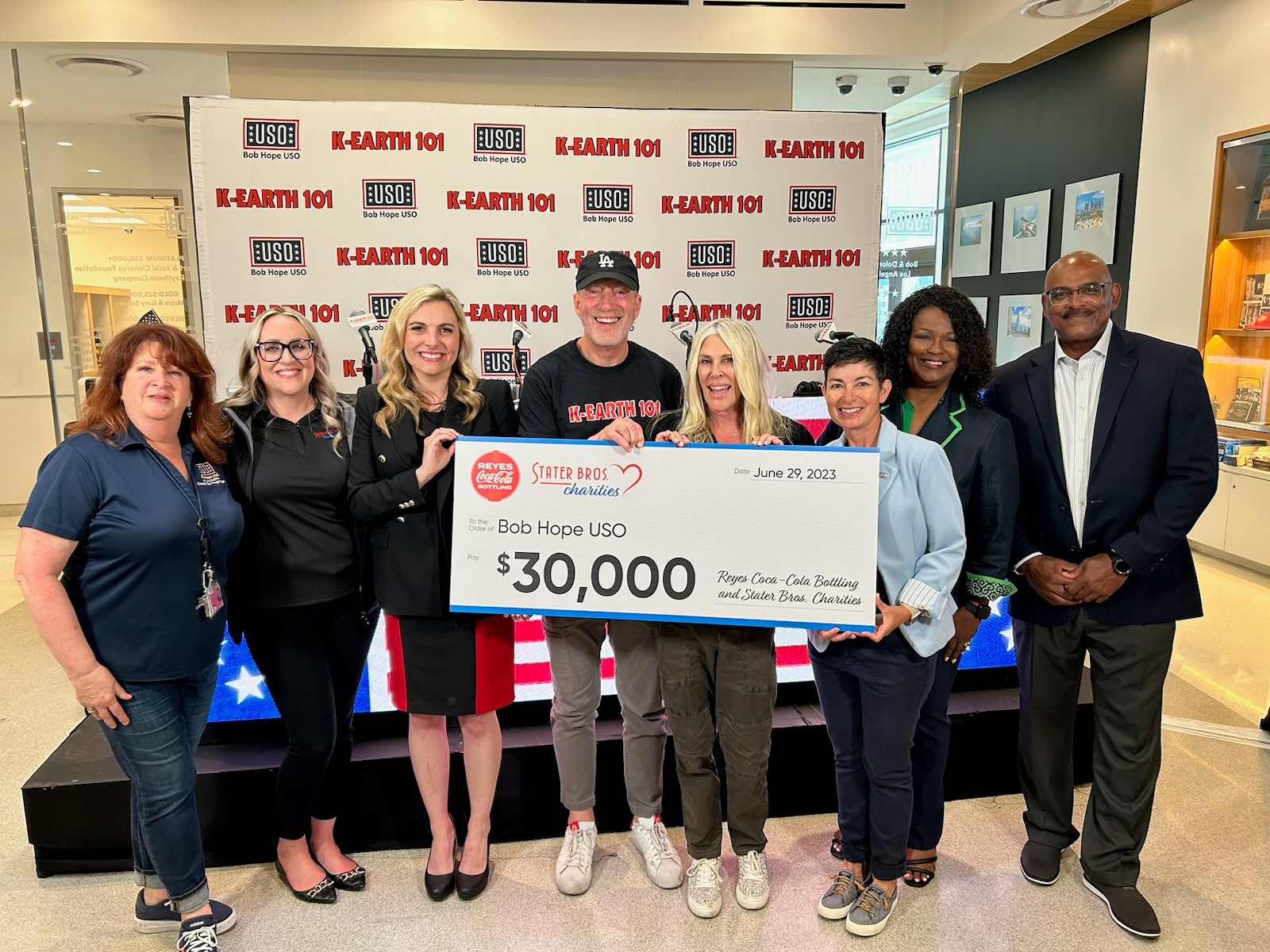

Stater Bros. Charities, the philanthropic arm of Stater Bros. Markets, partnered with Reyes Coca-Cola Bottling again this year for their Give Back program during National Military Appreciation Month. The program ran for the entire month of May, during which Reyes Coca-Cola Bottling committed to donating $0.25 per eligible product purchased to the Bob Hope USO. Reyes Coca-Cola Bottling donated $15,000, and Stater Bros. Charities matched their donation for a total contribution of $30,000.

A check presentation occurred during a K-EARTH 101 radiothon benefiting the Bob Hope USO. The radiothon took place at the Bob Hope USO at LAX (Los Angeles International Airport) on June 29, 2023, where Stater Bros. Charities and Reyes Coca-Cola Bottling presented Bob Hope USO with a $30,000 check.

Bob Hope USO’s mission is to strengthen America’s military service members by keeping them connected to family, home and country, throughout their service to the nation. The Give Back program is a unique opportunity to show gratitude and support to the brave men and women who risk their lives for our freedoms and to care for their families while they are away from home on deployment.

“Stater Bros. Markets has a long history of supporting veterans, service members, and their families,” said Danielle Oehlman, Director, Stater Bros. Charities. “We are so pleased to partner with our friends at Reyes Coca-Cola Bottling and the USO to give back to those who have given so much for us.”

Lorin Stewart, President, USO West Region, said, “We are deeply grateful to Stater Bros. Charities and Reyes Coca-Cola Bottling for being sustaining partners of the USO. The Give Back program embodies the essence of the USO mission by enabling the community at large to come together to support and give thanks to our armed forces and their brave military families in an impactful way.”

Funds will support the Bob Hope USO and USO San Diego Center operations, including programs and services that strengthen the social, mental, physical, and emotional well-being of local military service members, their families, and their communities.

-

Opinion1 month ago

Opinion1 month agoSurge in Unemployment Among California Youth Linked to Minimum Wage Hikes

-

Commercial Real Estate Transactions3 weeks ago

Commercial Real Estate Transactions3 weeks agoSRS Real Estate Partners Announces Record-Breaking $6.15 Million Ground Lease Sale of a New Construction Chick-fil-A Property in Murrieta, California

-

Health & Wellness3 weeks ago

Health & Wellness3 weeks agoBuddha Bars: A Mother’s Innovative Solution to Healthy Snacking

-

By Press Release1 week ago

California Employment Expansion Continues But Still Trails Nation