Real Estate

MBK Rental Living Sells Mitchell Place Apartments To MG Properties Group

REAL ESTATE TRANSACTION ALERT

230-unit, Class A Multifamily property located in Riverside County and within commuting distance to San Diego, Orange, and Los Angeles Counties

October 20, 2020 – Amid a national pandemic and economic turbulence for market investors, MBK Rental Living is delighted to have successfully delivered and professionally executed their sale of Mitchell Place, a 230-unit new Class A apartment community in Murrieta, Calif. to MG Properties Group.

Key Data Points:

- Mitchell Place is one of the largest apartment transactions of 2020 in the Inland Empire.

- The community was leased up in less than 12 months despite the impacts of the national pandemic, while raising rental rates and offering almost no concessions.

Opened in June 2019, the gated community consists of flats and townhomes with nine floor-plans. The one-, two- and three-bedroom residences range from 787 to 1,294 square feet. The amenity-filled property provides easy access to the I-15 and I-215 freeways, connecting residents to employment centers in the four Southern California counties of Riverside, San Diego, Orange, and Los Angeles. The community was designed with a multitude of common area amenities and is located near the shopping and dining venues of downtown Murrieta as well as the area’s wide variety of recreational sites.

“Mitchell Place established a new benchmark for rental living in SW Riverside County, with exceptional design, beautiful interior and exterior amenities, and designer-selected unit finishes. Murrieta continues to be an attractive market that investors want to be in for the long term due to its tremendous market fundamentals.” said Craig Jones, president of MBK Rental Living. “The location, combined with its exceptional design, made Mitchell Place an attractive investment opportunity for buyers despite the challenges posed by the pandemic. We’re pleased to have completed this transaction with MG.”

“We are pleased to add Mitchell Place to our Inland Empire portfolio. The property’s strong performance trends and the region’s robust economy make it an excellent fit for our long-term yield-oriented investment strategy,” said Mark Gleiberman, MG Properties Group’s CEO.

John Chu and Ed Rosen of Berkadia brokered the sale on behalf of MBK Rental Living. Financing was provided by Fannie Mae and arranged by Charles Christensen at Berkadia. MG Properties Group has purchased 8 communities in the past 12 months. These acquisitions totaled over 2,400 units and over $670 million in combined value. The company is targeting further acquisitions in Washington, Oregon, Arizona, California, Colorado, and Nevada.

Real Estate

McCarthy Building Companies Breaks Ground on $285M University of California, Riverside Student Housing Project

McCarthy Building Companies, Inc. (McCarthy) has broken ground on the $285M, 424,000 square-foot North District Phase 2 Student Housing Development at University of California, Riverside (UCR). This intersegmental project, one of the first of its kind in California, will house students from UCR and Riverside Community College District (RCCD), providing those students the opportunity to experience affordable campus living.

The recent surge in enrollment at UCR and RCCD colleges has created a substantial disparity between housing demand and available options. Students have been compelled to explore off-campus housing alternatives, which may not always be safe or convenient. This project aims to address the current housing shortage and ultimately provide a secure, comfortable, and modern living environment for both undergraduate and graduate students.

“The McCarthy team is proud to be part of this revolutionary project, which helps bridge the gap between larger universities and community colleges,” said Sarah Carr, Vice President, McCarthy. “This housing development will provide affordable options that will enhance graduation rates not only for UCR students, but for Riverside City College students as well – a benefit to the entire community.”

Located on UCR’s main campus, the project will provide 429 modern single and double occupancy apartment-style units ranging from one to four bedrooms and complete with kitchen/living room spaces along with contemporary amenities such as high-speed Wi-Fi, air conditioning, designated study areas, and communal spaces designed for both academic focus and social engagement, including a café/market, new recreation fields and a central park. The project has also received funding through the State Higher Education Student Housing Grant Program to provide affordable beds for UCR and Riverside City College students, bringing the total number of beds to 1,568 and ensuring that students from diverse backgrounds have access to safe, affordable housing.

“We can’t solve all the problems that are challenges for students, but we can solve those two by bringing students to the campus, letting them live here, wear their UCR or RCC T-shirt, and just be part of the campus,” said Kim Wilcox, Chancellor, UCR. “It breaks down a barrier and aside from the housing, it provides them with a different sense of themselves.”

This intersegmental housing project “is meticulously and intentionally designed to break persistent cultural and psychological barriers that many of our first-generation and low-income students experience through a process of total immersion into the UC system.” said Wolde-Ab Isaac, Chancellor, RCCD. “My hope is this unique partnership and innovative approach will serve as a model for others to emulate around the state.”

The first students of the North District Phase 2 Student Housing Development are expected to move in in 2025.

Business

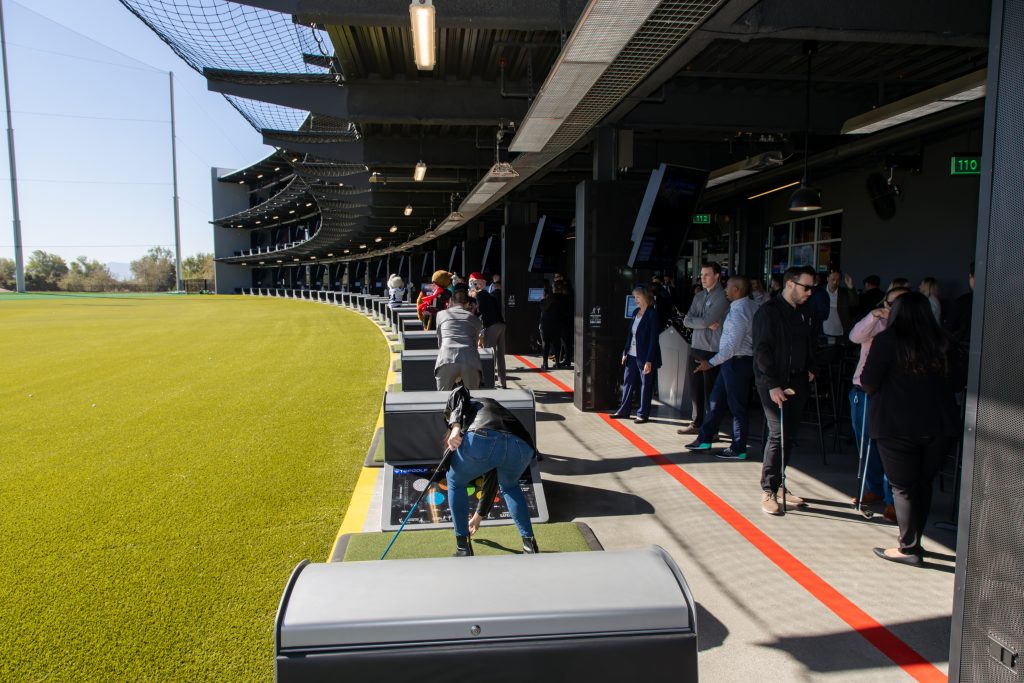

Topgolf Brings So Much More to San Bernardino County

By Chairman Curt Hagman

What a thrill celebrating the opening of the first Topgolf location in Southern California in the city of Ontario. While this entertainment experience brings a whole new level of high-quality recreation to our region, it represents so much more.

It was more than four years ago that the County pursued bringing Topgolf to 13.7 acres of undeveloped County-owned land in Ontario. Given the location of the land coupled with the socio-economic demographics of the area and recreational use restrictions, the County believed that Topgolf was an ideal fit for the site and developed a strategy to attract the company. This highly strategic initiative resulted in a 20-year ground lease agreement with Topgolf that was approved by the Board of Supervisors on April 30, 2019.

What is important to emphasize is that over the course of Topgolf’s 20-year ground lease, the County will receive more than $625,000 in annual revenue, benefiting the San Bernardino County Regional Parks system, which includes nine regional parks throughout the county and several other recreational attractions.

The Topgolf relationship represents the true value of a successful public-private partnership. While the County had the land, location, and workforce, Topgolf had the right business model, and that made all the difference.

The entertainment aspects of this new facility appeal to all ages. What started as a simple idea to enhance the game of golf has evolved into a best-in-class hospitality entertainment venue centered on a game that is accessible and appealing to all, regardless of skill or ability.

While the agreement facilitates the opening of a wonderful new entertainment destination for residents and visitors, the County’s park system gains a valuable income stream which even further benefits our county residents. More importantly, Topgolf’s business operations bring hundreds of new jobs that will enhance the local economy as well as create an important catalyst for new economic opportunities and investment.

While Topgolf executives chose San Bernardino County due to its convenient regional location, strong retail performance, and large and growing population base, they have also shared that the County was business-friendly since day one noting the County worked proactively throughout the deal process, solving any challenges along the way.

All told, this is an exciting and vital relationship with Topgolf that underscores the value of public-private partnerships and the excitement we all feel for this new first-ever Southern California Topgolf location.

Economy

California’s Rental, Housing Markets Defy Expectations in the Age of Covid

Rent Costs Decline Only Modestly and Home Prices Jump Across State’s Major Metros; Job Recovery Varies Significantly Between Regions

December 09, 2020 — California’s famously high-priced rental and homebuying markets have behaved in some surprising ways given the job and other economic losses suffered during the COVID-19 pandemic. Over the past year, with one exception, rents haven’t budged much, and home prices have climbed, and sometimes soared, in every single metro region of the state, according to a new analysis released today by Beacon Economics.

“The pandemic has underscored just how stubbornly imbalanced and unaffordable California’s housing and rental markets are,” said Taner Osman, Research Manager at Beacon Economics. “We’ve long suffered from a lack of adequate housing supply, but it’s quite amazing that demand has held firm and even grown given the unprecedented shock COVID-19 has delivered to the wider economy.”

For the most part, the places where rents have fallen have been high-priced and/or densely urban locations such as San Francisco, downtown San Diego, and tony neighborhoods in Los Angeles and the South Bay. Declines in these areas have largely been due to an exodus of renters who have left for less populated, less expensive suburban environments, according to the analysis.

“The effects of the pandemic are likely at work here as these trends appear to be related to both fear of the virus and perhaps more prominently, the major shift we’ve seen towards working from home, where you don’t need to be physically close to your place of employment,” said Osman. However, according to the analysis, the ‘demise’ of urban centers that has been suggested by many observers is highly exaggerated.

Major rental market findings by region include:

- San Francisco Metro (SF and San Mateo Counties): Pandemic-related rent declines have been sharpest in this region with the average rent per unit falling 9.6% ($3270 to $2957) from September 2019 to September 2020. The largest declines were primarily in the most expensive neighborhoods with the Marina/Pacific Heights sustaining a 15.8% drop. Across the region, however, rental vacancies rose just 0.6%.

- Los Angeles Metro (Los Angeles-Long Beach-Glendale MD): Rents in the Los Angeles metro have held fairly steady with average rent declining just 2.9% to $2073 per unit from September 2019 to September 2020. Like San Francisco, the largest decline came from one of the most expensive neighborhoods: Marina del Rey/Venice/Westchester with a 6.9% annualized decrease in average rent. Some LA neighborhoods sustained rent increases with the largest occurring in the Carson/San Pedro/East Torrance area (+3.3%).

- San Diego Metro (San Diego County): The pandemic has had only a minimal effect on rental costs in San Diego County with average rent virtually unchanged from September 2019 to September 2020 ($1881 to $1867). In fact, more of San Diego’s neighborhoods have sustained rent increases than declines. The largest increase occurred in the Escondido/San Marcos submarket (+3%) and the largest decline was in the La Jolla/ University City submarket, a more expensive neighborhood (-6.1%).

- South Bay (Santa Clara and San Benito Counties): The South Bay, the world’s leading tech economy and generally a very high-priced region, has experienced a pandemic-driven decline in rent but not at a level that might be expected. The region’s average rent decreased 5.1% from September 2019 to September 2020 ($2755 to $2614) with significant declines in Mountain View/Los Altos (10.2%) and Northeast San Jose (7%), but much smaller drops in most other neighborhoods.

- East Bay (Alameda and Contra Costa Counties): Rent in the East Bay metro has not been significantly affected by the pandemic. Average rent in the region stands at $2294 per unit, a 3.1% drop from September 2019 to September 2020. Unlike other areas of the state, the largest rent declines in the East Bay have not come from the most expensive or centrally located neighborhoods. The Fremont/Newark/Union City submarket, which is one of the furthest from downtown San Francisco, sustained a 7.9% decline in rent while the North Alameda submarket, which includes Oakland and Berkeley, fell only 2.9%.

Without exception, over the past year, home prices and home sales in every major metro in California have grown significantly, and in some cases dramatically:

- San Francisco Metro: The median home price is up 8.1% and existing home sales have soared by an astounding 90.2%, suggesting pent up demand.

- Los Angeles Metro: The median home price has climbed 12.7% and existing home sales have risen 16.4%.

- San Diego Metro: The median home price has jumped 15.4% and existing home sales have surged 32.8%.

- South Bay: The median home price has increased 14.5% and existing home sales have ballooned by 36%.

- East Bay: The median home price in both counties in the East Bay have experienced a surge with Alameda County jumping 15.4% and Contra Costa County rocketing up 19.4%. Home sales have risen 32.2% in Alameda County and 35.2% in Contra Costa County.

The new analysis also finds that employment increased across all the state’s major metros in October 2020, the most recent data available, with each region adding back jobs lost during the course of the pandemic. The rate of recovery, however, varies significantly, ranging from modest in San Francisco to robust in Los Angeles. Employment in the Los Angeles metro now stands at 90.9% of the region’s pre-pandemic level.

-

Opinion1 month ago

Opinion1 month agoSurge in Unemployment Among California Youth Linked to Minimum Wage Hikes

-

Commercial Real Estate Transactions3 weeks ago

Commercial Real Estate Transactions3 weeks agoSRS Real Estate Partners Announces Record-Breaking $6.15 Million Ground Lease Sale of a New Construction Chick-fil-A Property in Murrieta, California

-

Health & Wellness3 weeks ago

Health & Wellness3 weeks agoBuddha Bars: A Mother’s Innovative Solution to Healthy Snacking

-

By Press Release1 week ago

California Employment Expansion Continues But Still Trails Nation