Commercial Real Estate

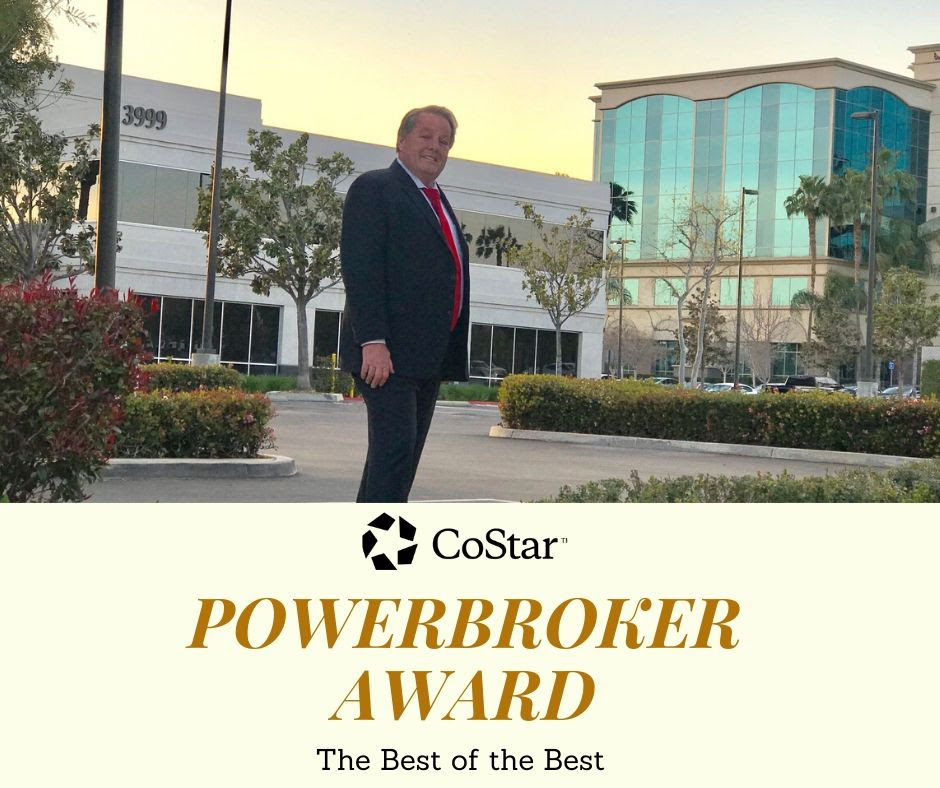

People On The Move: Michael G. Rademaker

PEOPLE ON THE MOVE

Michael G. Rademaker

MGR CEO Recognized with Prestigious Award

Michael G. Rademaker, MGR’s Founder & CEO, has recently received CoStar’s 2019 Power Broker Award. As one of the leaders in acquiring and professionally managing commercial real estate in the Inland Empire, Rademaker has been named as a CoStar Power Broker for his transaction volume in 2019 against all other active brokers in their market.

The CoStar Power Broker Award is awarded by the CoStar Group Inc., as the leading provider for commercial real estate information, analytics, and online marketplaces. The prestigious award is now in its 20th year and recently expanded to 26 new markets. The Power Broker Awards honors those who have closed the highest transaction volume in commercial real estate in their perspective markets.

Please help us in congratulating Michael Rademaker on their 2019 Power Broker Award in the Inland Empire market.

ABOUT MICHAEL

Michael G. Rademaker is the CEO/Founder of MGR Real Estate, MGR Services, and MGR Property Management. He has over 35 years of real estate sales, leasing and property management experience. MGR currently has 3 regional locations strategically located in Upland, Colton, and Victorville to service Los Angeles, Orange, Riverside, and San Bernardino Counties.

Michael leads the commercial team of sales, leasing and management professionals at MGR. His knowledge and expertise in real estate investments allow him to successfully guide a team of nearly 400 seasoned sales professionals and provides representation to a vast clientele of commercial and residential real estate investors. He has a thorough and complete knowledge of all aspects of residential and commercial real estate investments’ including multi-family, office, retail, industrial, land, apartments, hotels and restaurants, business opportunities, and other commercial properties.

Mr. Rademaker is recognized for his exceptional success in growing clients’ real estate investment portfolios and possesses the ability to provide clients with an unparalleled perspective on the local investment real estate market. Michael has an outstanding ability to thoroughly analyze commercial properties to create a successful positioning strategy that will maximize the client’s opportunities. His approach is simple; treat client investments like it’s our own – an approach that continually results in increased value to MGR clients investment portfolios.

Under his leadership, MGR Real Estate and MGR Property Management have emerged as one of the leading residential and commercial real estate sales, leasing, and management companies in Southern California.

Professional Titles

CEO/Founder of MGR Services — Est. 1983 Corporate Office – Upland, CA

CEO/Founder of MGR Real Estate — Est. 2008 Corporate Office – Upland, CA

CEO/Founder of MGR Property Management — Est. 2008 Corporate Office – Upland, CA

Professional Summary

- Owns three firms, each structured to meet the real estate needs of clients’ objectives.

- Oversees operations of three office locations: Upland, Victorville, and Colton. Each office is strategically located to service a specific region. Upland is centrally located to service the entire Inland Empire and touches the borders of the Los Angeles and Orange counties. Victorville services the entire High Desert, and Colton effectively services Riverside County.

- Both MGR Services and MGR Real Estate have a large staff of seasoned and highly skilled professionals acquired from national offices. There are currently over 350 salespersons and broker associates combined.

- REO expert – Currently handling hundreds of residential REOs with quick sales at top prices.

- Expert in brokering sales for local and international investors.

- Maintains solid relationships with real estate support services, and specialists in the fields of finance, construction, law, accounting, marketing, escrow, and title.

- MGR Property Management manages everything from residential rentals to large income properties including office buildings, retail centers, and apartment complexes. Experts in all facets of property management: leasing, maintenance, tenants, rent collection, legal, accounting, etc. Staff is comprised of highly skilled managers specifically trained to maximize clients’ investments through hands-on approach and efficiency.

- Has been performing construction management of residential and commercial properties since 1983.

Professional Achievements

- Over 35 years of servicing real estate sales and leasing and property management, with areas of expertise in investment properties such as office buildings, retail centers, industrial buildings, apartment properties, single-tenant net-lease properties, hotels/motels, multi-family and residential properties, manufactured home communities, senior housing facilities, and land.

- Spearheaded the companies’ combined growth to over 400 sales professionals that provide representation to a vast clientele of residential and commercial investors.

- Ability to provide clients with an unparalleled perspective on the local investment real estate market.

- Recognized for his exceptional success in growing clients’ real estate investment portfolios.

- Outstanding ability to thoroughly analyze commercial properties to create a successful positioning strategy that will maximize the client’s opportunities.

- Established solid relationships with numerous large national banks to successfully liquidate REO inventories.

- Consistently named one of the Inland Empire’s top brokerages by CoStar Group, a recognized leader in commercial information.

Professional Areas of Expertise

- Value Analysis & Evaluations Value Enhancement

- Property & Asset Management

- Leasing, Sales & Exchanges

- Expert and Professional Negotiation

- Value Enhancement

- Marketing & Promotion

Professional Affiliations

- NAR – National Association of Realtors

- CREOBA – Commercial REO Brokers Association

- AIR – American Industrial Real Estate Association

- CAR – California Associations of Realtors

Commercial Real Estate Transactions

Hanley Investment Group Arranges Sale of Grocery-Anchored Shopping Center in Southern California

Sierra del Oro Towne Centre is Hanley Investment Group’s sixth grocery-anchored shopping center sale over the last 12 months

Hanley Investment Group Real Estate Advisors, a nationally recognized real estate brokerage and advisory firm specializing in retail property sales, announced today that the firm arranged the sale of Sierra del Oro Towne Centre, a 100%-occupied, 110,485-square-foot shopping center anchored by Ralphs and Dollar Tree in Corona, California. The sale price was not disclosed.

Sierra del Oro Towne Centre is Hanley Investment Group’s sixth grocery-anchored shopping center sale over the last 12 months.

Hanley Investment Group Executive Vice President Kevin Fryman and President Ed Hanley represented the seller, Phillips Edison & Company, Inc. (Nasdaq: PECO), one of the nation’s largest owners and operators of high-quality, grocery-anchored neighborhood shopping centers, headquartered in Cincinnati, Ohio. The buyer, a private 1031 exchange investor based in Northern California, was represented by Jesse Millman of Newmark.

In 2017, Hanley Investment Group represented the seller, Cornerstone Development Partners of Irvine, California, in the sale of Sierra del Oro Towne Centre, when Phillips Edison & Company was the buyer.

“We secured a private all-cash 1031 exchange buyer who had recently sold their property to a land developer,” said Fryman. “We negotiated an expedited due diligence and closing timeline to provide the seller with certainty of execution.”

Fryman added, “Prior to marketing the property for sale, we advised the seller to structure a new long-term lease with Ralphs to maximize value and align with private capital’s objective of having a strong, committed anchor at the center.”

In addition to Ralphs and Dollar Tree, tenants at Sierra del Oro Towne Centre include Anytime Fitness, Chase Bank, Jack in the Box, Domino’s Pizza, Wingstop, Green River Montessori, Kumon Math and Reading Center, Fantastic Sams, and PostalAnnex.

According to Fryman, 72% of the tenants have operated at the center since at least 2011, and 70% are national or regional brands.

“The sale of Sierra del Oro represented a unique opportunity to acquire an entire grocery-anchored shopping center, including the anchors, shop tenants, and pad building ground leases in an affluent market located in Southern California,” said Fryman. “Ralphs has operated at the shopping center since it was originally constructed in 1991 and had recently executed a new long-term lease, demonstrating their commitment to the location. Furthermore, Ralphs is the only traditional grocery store within a three-mile radius.”

Fryman noted that the average household income within a one-mile radius of the property exceeds $145,000, and there are 148,000 people within a five-mile radius. The property is conveniently situated less than one mile from the Serfas Club Drive exit and two miles from the Green River Road exit on the 91 Freeway, which carries 275,000 cars per day.

Ralphs’ parent company, Kroger (NYSE: KR; S&P: BBB investment grade), operates over 2,700 grocery stores nationwide and is the largest traditional grocery operator in the U.S. with more than $148 billion in annual revenue. Ralphs, a staple grocery store chain in Southern California, has served its communities since 1873, making it one of the oldest continuously operating grocery brands in the United States. Today, Ralphs has more than 180 locations throughout Southern California and is the market share leader in the region.

“Investor demand for grocery-anchored retail centers remains exceptionally strong, driven by the stability and daily traffic that grocers like Ralphs generate,” said Hanley. “Both private and institutional buyers continue to target these assets for their long-term income durability and resistance to e-commerce disruption. With consistent foot traffic, strong tenant fundamentals, and limited new supply in high-growth markets, grocery-anchored centers offer a compelling investment profile.”

Commercial Real Estate

Dedeaux Properties Completes Strategic Expansion with 850,000 Square Feet of New Industrial Developments Across Southern California

Innovative Logistics Facilities Launched Amid Scarce Market Inventory to Meet Growing Demand

Dedeaux Properties, a leader in logistics real estate, has successfully obtained Certificates of Occupancy for five newly constructed industrial developments across Southern California, cumulatively encompassing approximately 850,000 square feet. This significant expansion comes at a pivotal time when the availability of new industrial spaces in Southern California is at its lowest in over a decade, according to recent market analyses.

The assortment of state-of-the-art developments includes:

- A 167,000-square-foot warehouse strategically located in Ontario.

- A sprawling 326,000-square-foot warehouse in Riverside.

- A 165,000-square-foot high-velocity distribution center in Fontana, tailored for rapid logistics operations.

- A 53,000-square-foot cross-dock facility in Perris, designed to enhance transshipment efficiency.

- A 52,000-square-foot cross-dock in San Bernardino, geared towards facilitating quicker load transfers.

- An 83,000-square-foot distribution center in Rialto, optimized for both storage and distribution functionalities.

These projects have been meticulously developed to cater to the surging demand for high-quality logistics real estate fueled by the consistent record cargo volumes handled at the Ports of Los Angeles and Long Beach.

Matt Evans, President of Dedeaux Properties, reflects on the current market dynamics and the firm’s strategic response. “The recent disruptions in capital markets have posed significant challenges for many developers in securing construction financing, leading to a thinner market. However, the Inland Empire continues to be a magnet for industrial activities, thanks to its proximity to major ports. Our new facilities are not just buildings; they are state-of-the-art logistics solutions designed to support the dynamic needs of modern supply chains.”

To further position itself for sustained growth and leverage potential market opportunities in 2025 and beyond, Dedeaux Properties has also successfully executed several strategic financial initiatives:

- Recapitalization of a stabilized Industrial Outdoor Storage Portfolio that includes three sites totaling 1.1 million square feet of land in San Bernardino County. This transaction was conducted in partnership with the Carlyle Group, ensuring continued benefits from stable cash flows.

- Divestiture of the firm’s inaugural Kern County development at Tejon Ranch to a textile owner/user, which has also facilitated an expanded relationship with Tejon Ranch Company for an additional warehouse project in Lebec.

- Refinancing and restructuring of the financing arrangements for the majority of the projects completed in 2024, which has freed up substantial equity for future acquisitions and developments.

“These proactive steps have not only solidified our financial foundation but have also allowed us to optimize our asset base, ensuring substantial returns for our stakeholders and enhancing our capacity to seize emerging opportunities in the logistics sector,” Evans concluded.

Commercial Real Estate

Affinius Capital and McDonald Property Group Execute Pre-Lease with Otto Cap at The HUB @ Ontario International Airport

Affinius Capital and McDonald Property Group are pleased to announce the signing of a major lease with Otto International, Inc., at The HUB. This 254,677-sq.- ft.-building lease located at 3551 East Jurupa Street, City of Ontario establishes The HUB’s first lease at its premier master-planned logistics park in Ontario, Calif. It has been secured six months prior to the scheduled completion of its initial Phase 1 of the project totaling two million sq. ft. consisting of four buildings.

The project ownership is CanAm Ontario, LLC, which consists of a notable Canadian pension fund, an investment affiliate of Affinius Capital, and McDonald Property Group. CanAm Ontario recently executed a 55-year ground lease with Ontario International Airport Authority to develop the entire 200-acre site.

“Securing this lease ahead of completion underscores the appeal of The HUB’s quality and location adjacent to Ontario International Airport,” said Eddie Gonzalez, managing director of asset management for Affinius Capital. “We are privileged that Otto International selected our Inland Empire development and pleased to count them among the companies we serve throughout our global industrial and logistics portfolio.”

Otto International committed to this long-term 154-month lease with CanAm Ontario to satisfy its expansion and future growth needs. The building will operate to scale up Otto’s next day’s shipping promise at larger volumes and reduce costs through new fulfillment automation integrated in the facility. With over 70 years of experience, Otto has established itself as a leading global manufacturer of quality headwear with 20,000 active wholesale partners.

“Otto is extremely proud to partner with Affinius Capital and McDonald Property Group in the development of our soon-to-be flagship West Coast Distribution Center in Ontario, California,” stated Mr. Razgo Lee, Chief Executive Officer of Otto International. “Our new robotic automated facility at The HUB will allow us to streamline our West Coast logistical hub and distribution point as the premier tenant in this amazing facility. We are honored to participate in such a monumental project which will support our growth plan and commitment to our valued customers.”

Darla Longo, Barbara Perrier, Walt Arrington, Joey Sugar and Joe Werdein represented McDonald Property Group and Affinius Capital in the lease transaction. Dylan McDonald and Dillon Dummit of Savills International represented Otto International.

Situated directly across from Ontario International Airport (ONT) in San Bernardino County, the project is notable for its scope, location, timeline and complexity. It will also be one of the first large-scale developments in Southern California to incorporate an innovative carbon-reduction system for the slab, tilt wall panels and paving as part of Affinius Capital’s strategic plan for achieving its environmental sustainability goals through concrete decarbonization methods. Multiple strategies for incorporating concrete decarbonization, sustainable elements and achieving LEED® Gold certification for this industrial development were identified. The carbon reduction of emissions volume resulting from this project, as compared to conventional concrete design for industrial projects, will achieve 35% less embodied carbon from a conventional concrete design or approximately 44,000 tons less embodied carbon released into the atmosphere across the entire HUB development.

-

Technology3 months ago

Technology3 months agoLA Tech Week Highlights Southern California’s Expanding Tech Ecosystem

-

Entertainment2 months ago

Entertainment2 months agoROI: Return on Insanity—Lucha VaVoom’s High-Yield Investment in the Pomona Arts Colony

-

Bizz Buzz2 months ago

Bizz Buzz2 months agoRegency Centers Unveils Oak Valley Village: A New Retail Hub Coming to Beaumont, CA

-

Food & Lifestyle3 months ago

Food & Lifestyle3 months agoFogo de Chão Heats Up Rancho Cucamonga Dining Scene

-

Travel & Tourism2 months ago

Travel & Tourism2 months agoFly Ontario, Calif., to Honolulu aboard Southwest Airlines starting in June

-

Transportation1 month ago

Transportation1 month agoRegional Leaders Launch “Coalition for Our Future” to Advance Urgent Safety Solutions for I-15 Corridor